Mergers and acquisitions (M&A) are complex processes that require a lot of planning and coordination. One of the biggest challenges is managing the vast amount of confidential data that is shared between the parties involved. Virtual data rooms (VDRs) are secure online platforms that help streamline this process and improve M&A success rates.

VDRs provide a central location for all M&A documents, making it easy for both parties to access and review them. This eliminates the need for physical storage and delivery of documents, which can be time-consuming and inefficient. Additionally, VDRs offer robust security features that protect confidential data from unauthorized access. With features such as granular access controls and advanced encryption, VDRs ensure that only authorized users can access specific documents.

Moreover, VDRs allow for real-time collaboration and communication, facilitating seamless communication and negotiation between the parties. Features like version control and activity tracking provide a complete audit trail, improving transparency and trust throughout the process. The efficient data sharing and collaboration offered by VDRs not only streamline the M&A process but also reduce the risk of costly errors or delays.

By using a VDR, M&A teams can stay organized, efficient, and secure, significantly contributing to increased success rates in this complex field.

The benefits of VDRs go beyond just managing documents. In fact, using a VDR can be a game-changer in several aspects of M&A deals, boosting the overall success rates significantly.

5 Ways Virtual Data Rooms Boost M&A achievement Rates

Mergers and acquisitions (M&A) are complex transactions that require meticulous planning, careful execution, and a seamless flow of information. One of the most critical stages in any M&A deal is due diligence, a thorough examination of the target company’s financials, operations, and legal compliance. Traditionally, due diligence involved physical document exchange, lengthy email chains, and multiple in-person meetings. However, with the rise of virtual data rooms (VDRs), M&A processes are becoming more efficient, secure, and transparent.

What is a Virtual Data Room?

A virtual data room (VDR) is a secure online platform that enables companies to securely share and manage sensitive documents during M&A transactions. It acts as a central repository for all due diligence materials, allowing for streamlined access and collaboration between parties.

How does a VDR work?

VDRs function as secure cloud-based platforms with robust access controls. They allow authorized users to access and manage a wide scope of documents, including financial statements, contracts, legal documents, and other sensitive information. Users can upload, download, and track document activity, ensuring transparency and accountability throughout the due diligence process.

What are the benefits of using a VDR?

VDRs offer numerous benefits for M&A transactions, including enhanced security, improved collaboration, centralized document access, and boostd transparency.

The Importance of Due Diligence in M&A

What is due diligence?

Due diligence is the process of thoroughly investigating the target company before a potential acquisition. It involves examining the company’s financial performance, operations, legal compliance, and other pertinent facets to assess its value and determine any potential risks.

Why is due diligence crucial in M&A?

Due diligence is crucial in M&A because it helps acquirers:

- Make informed decisions: Thorough due diligence offers a thorough understanding of the target company, allowing acquirers to make informed decisions about whether or not to proceed with the acquisition.

- determine potential risks: Due diligence helps determine potential risks associated with the target company, such as financial irregularities, legal liabilities, or environmental issues. This allows acquirers to negotiate better terms or withdraw from the deal if necessary.

- Assess the target company’s value: Due diligence offers valuable insights into the target company’s financial health, industry position, and rival landscape, enabling acquirers to accurately assess its value.

- Prevent future problems: By determineing and addressing potential risks during due diligence, acquirers can minimize the likelihood of facing unexpected problems or legal issues after the acquisition.

What are the challenges of traditional due diligence?

Traditional due diligence methods often face challenges such as:

- Security risks: Sharing sensitive documents through physical delivery or email raises security concerns.

- Inefficient communication: Coordinating with multiple parties through emails and phone calls can be time-consuming and prone to miscommunication.

- Limited access: Controlling access to documents and tracking activity is challenging with traditional methods.

- Lack of transparency: It can be difficult to track who has accessed which documents and when.

How Virtual Data Rooms Streamline Due Diligence

VDRs address these challenges by offering a secure, efficient, and transparent platform for due diligence. Here are some key ways VDRs streamline the process:

Enhanced Security

What security attributes do VDRs offer?

VDRs offer a wide scope of security attributes, including:

- Data encryption: All data stored and transmitted through VDRs is encrypted, protecting it from unauthorized access.

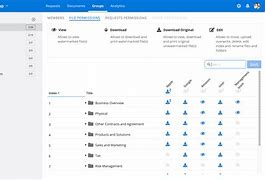

- Access controls: VDRs allow administrators to set granular access controls, ensuring only authorized personnel can view specific documents.

- Two-factor authentication: VDRs typically require two-factor authentication, adding an extra layer of security to user accounts.

- Audit trails: VDRs record all user activity, providing a detailed audit trail for tracking access and document changes.

How do VDRs protect sensitive information?

By implementing these security attributes, VDRs ensure that confidential information remains protected throughout the due diligence process.

Improved Collaboration

How do VDRs facilitate communication between parties?

VDRs facilitate efficient communication between parties through attributes like:

- Secure messaging: VDRs offer secure messaging capabilities, allowing parties to communicate about the due diligence process directly within the platform.

- Document annotations: VDRs allow users to annotate documents, providing a platform for collaborative discussions and feedback.

- Version control: VDRs track document versions, ensuring that all parties are working with the most up-to-date information.

How do VDRs make the due diligence process more efficient?

By enabling secure, transparent, and efficient communication, VDRs significantly streamline the due diligence process.

Centralized Document Access

How do VDRs organize and manage documents?

VDRs offer a centralized repository for all due diligence documents, allowing for efficient organization and management:

- Document indexing and tagging: VDRs allow users to index and tag documents, making it easy to search for specific information.

- Folder structures: VDRs offer flexible folder structures, allowing users to organize documents logically.

- Document versioning: VDRs track document versions, ensuring that all parties are working with the most up-to-date information.

How do VDRs ensure that all parties have access to the necessary information?

VDRs ensure that all parties involved in the due diligence process have access to the necessary information, eliminating the need for multiple emails or physical document transfers.

5 Ways Virtual Data Rooms Boost M&A achievement Rates

Faster Deal Closure

How do VDRs speed up the due diligence process?

VDRs streamline the due diligence process, leading to faster deal closure:

- Reduced time for document access: VDRs offer immediate access to documents, eliminating the time required for physical delivery or email exchange.

- Simplified communication: VDRs facilitate efficient communication between parties, reducing delays caused by miscommunication or lengthy email chains.

- Automated processes: VDRs offer attributes like automated document indexing and access control, further streamlining the process.

How do VDRs reduce delays and bottlenecks?

By eliminating delays and bottlenecks associated with traditional due diligence methods, VDRs significantly accelerate the deal closure process.

boostd Transparency

How do VDRs improve transparency in the due diligence process?

VDRs enhance transparency by:

- Real-time document access: VDRs offer real-time access to documents, ensuring that all parties are working with the same information.

- Document activity tracking: VDRs track document access and changes, providing an audit trail for complete transparency.

- Reduced room for miscommunication: VDRs’ secure messaging and annotation attributes minimize the risk of misunderstandings.

How do VDRs build trust between parties?

By fostering transparency and accountability, VDRs build trust between the parties involved in the M&A transaction.

Reduced Costs

How do VDRs save money on the due diligence process?

VDRs offer significant cost savings by:

- Eliminating printing and shipping costs: VDRs eliminate the need for physical documents, saving on printing and shipping costs.

- Reducing travel expenses: VDRs facilitate remote collaboration, reducing the need for in-person meetings and travel expenses.

- Streamlining administrative tasks: VDRs automate administrative tasks, complimentarying up staff time and reducing administrative costs.

What are the cost-saving benefits of using a VDR?

Overall, VDRs offer cost-effective solutions for M&A transactions, enabling significant savings without compromising security or efficiency.

Improved Data Security

How do VDRs protect data from breaches?

VDRs offer robust security attributes to protect data from breaches, including:

- Data encryption: VDRs use advanced encryption methods to protect data both at rest and in transit.

- Firewall protection: VDRs are protected by firewalls to prevent unauthorized access.

- Regular security audits: VDR offerrs conduct regular security audits to ensure compliance with industry optimal practices.

How do VDRs ensure compliance with regulations?

VDRs comply with industry regulations, such as GDPR and HIPAA, ensuring that sensitive information is handled securely and ethically.

Enhanced Deal achievement

How do VDRs boost the likelihood of a achievementful M&A deal?

VDRs contribute to a achievementful M&A deal by:

- Facilitating efficient due diligence: VDRs streamline the due diligence process, ensuring a thorough and thorough examination of the target company.

- Building trust and transparency: VDRs foster transparency and accountability, building trust between parties and creating a more favorable environment for negotiation.

- Minimizing risks: VDRs help determine potential risks early in the process, allowing acquirers to negotiate better terms or withdraw from the deal if necessary.

What are the key factors that contribute to M&A achievement?

Several factors contribute to M&A achievement, including:

- Thorough due diligence: A thorough and efficient due diligence process is essential for making informed decisions and determineing potential risks.

- Effective communication: Clear and transparent communication between parties is critical for building trust and facilitating smooth negotiations.

- Strong integration planning: Developing a solid integration plan is essential for minimizing disruption and maximizing the value of the acquisition.

Choosing the Right Virtual Data Room for Your M&A Deal

What factors should you consider when selecting a VDR?

When choosing a VDR for your M&A deal, consider factors like:

- Security attributes: Ensure the VDR offers robust security attributes to protect sensitive information.

- Ease of use: select a VDR that is user-friendly and intuitive for all parties involved.

- attributes: Look for attributes that meet your specific needs, such as document indexing, version control, and secure messaging.

- Pricing: Consider the pricing model and compare varied VDR offerrs to find the optimal value.

- Customer support: select a offerr with excellent customer support to ensure you receive timely assistance.

What attributes are essential for a achievementful VDR?

Essential VDR attributes include:

- Secure access controls: Granular access controls to ensure only authorized individuals can access specific documents.

- Document indexing and tagging: Efficient document indexing and tagging for easy search and retrieval.

- Version control: Tracking document versions to ensure all parties are working with the most up-to-date information.

- Secure messaging: Secure messaging capabilities for efficient communication between parties.

- Audit trails: Detailed audit trails to track document access and changes.

What are some popular VDR offerrs?

Some popular VDR offerrs include:

- Intralinks: A leading offerr of VDR solutions with a wide scope of attributes and robust security.

- Firmex: Known for its user-friendly interface and thorough security attributes.

- ShareFile: A popular offerr offering both VDR and document sharing solutions.

- CapLinked: Known for its innovative attributes and flexible pricing models.

- Diligent: A leading offerr of VDR solutions with a focus on compliance and security.

Conclusion

Virtual data rooms have revolutionized the way M&A transactions are conducted. By providing a secure, efficient, and transparent platform for due diligence, VDRs accelerate deal closure, boost transparency, and enhance deal achievement.

The benefits of using a VDR in M&A are undeniable. They improve communication, streamline processes, enhance security, and ultimately contribute to more achievementful M&A outcomes. As you embark on your next M&A transaction, consider the benefits of using a VDR to maximize your due diligence process and boost your chances of a achievementful deal.