- The Rise of Virtual Data Rooms in the Financial Sector

- What are Virtual Data Rooms?

- Defining Virtual Data Rooms (VDRs): A secure online platform for storing, sharing, and managing sensitive documents.

- VDRs vs. Traditional Data Rooms: benefits of VDRs over physical data rooms in terms of efficiency, security, and cost-efficacy.

- Why are VDRs Essential in the Financial Sector?

- The benefits of Using VDRs in Financial Transactions

- Use Cases of VDRs in Financial Transactions

- Choosing the Right VDR for Your Financial Needs

- Industry-Specific VDRs: Options tailored to the unique requirements of the financial sector.

- Evaluating VDR offerrs: Comparing attributes, pricing, and customer reviews to select the optimal fit.

- Conclusion

The financial sector, known for its high stakes and stringent security measures, has always been a pioneer in adopting innovative technologies. In recent years, a powerful new tool has emerged, transforming the way deals are conducted and information is shared: the Virtual Data Room (VDR). This shift from physical data rooms, where physical documents were physically transported and stored, to a secure, cloud-based platform is ushering in a new era of efficiency, accessibility, and security.

VDRs are secure online repositories, essentially virtual spaces where vast amounts of confidential documents can be stored and shared. These platforms are being embraced by financial institutions for their significant benefits across various phases of the financial deal-making process.

One key reason for the VDR’s popularity is its remarkable ability to streamline due diligence. Previously, due diligence investigations, involving sifting through voluminous documents, could take weeks, or even months. With a VDR, documents are readily accessible, easily searchable, and quickly shared. This enables both sides to review all relevant information swiftly, accelerating the deal process.

The secure nature of VDRs offers a crucial advantage in a sector where data privacy and security are paramount. Data stored within VDRs are often encrypted, ensuring that access is restricted to authorized individuals, and comprehensive audit trails track every access event. This stringent security framework minimizes the risks of data breaches and leaks, protecting sensitive financial information.

The Rise of Virtual Data Rooms in the Financial Sector

The financial sector is constantly evolving, with new technologies emerging to streamline operations and enhance security. One such technology that has gained significant traction in recent years is the Virtual Data Room (VDR). VDRs have revolutionized the way financial institutions manage sensitive data, collaborate with stakeholders, and execute complex transactions, particularly in the realm of mergers and acquisitions (M&A).

What are Virtual Data Rooms?

Virtual Data Rooms are secure online platforms designed for storing, sharing, and managing sensitive documents. They offer a centralized repository for all pertinent information related to a specific project or transaction, enabling authorized users to access and collaborate on documents from anywhere with an internet connection.

Defining Virtual Data Rooms (VDRs): A secure online platform for storing, sharing, and managing sensitive documents.

VDRs are essentially digitized versions of traditional physical data rooms, providing a more efficient and secure alternative. They offer a scope of attributes designed to meet the unique needs of financial transactions, including:

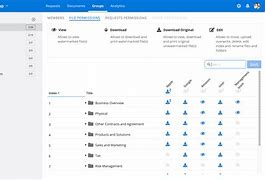

- Access control: VDRs allow administrators to define user functions and permissions, ensuring that only authorized individuals can access specific documents or folders. This granular access control helps maintain data confidentiality and compliance.

- Audit trails: All actions performed within a VDR are meticulously recorded, providing a thorough audit trail that tracks document access, edits, and downloads. This attribute is crucial for regulatory compliance and accountability.

- Document versioning: VDRs maintain a history of all document revisions, allowing users to track changes, revert to previous versions, and maintain a clear record of the document’s evolution.

- Robust security measures: VDRs employ advanced security measures, including encryption, multi-factor authentication, and secure data storage, to protect sensitive financial information from unauthorized access or breaches.

VDRs vs. Traditional Data Rooms: benefits of VDRs over physical data rooms in terms of efficiency, security, and cost-efficacy.

VDRs offer a distinct benefit over traditional physical data rooms in several ways:

- Efficiency: VDRs eliminate the need for physical document storage, retrieval, and transportation, streamlining workflows and reducing administrative burdens.

- Security: VDRs offer a much higher level of security than physical data rooms, which can be vulnerable to theft, damage, or unauthorized access.

- Cost-efficacy: VDRs reduce the costs associated with physical data rooms, including printing, storage, travel, and administrative overhead.

Why are VDRs Essential in the Financial Sector?

The financial sector relies heavily on secure document sharing and collaboration, making VDRs an indispensable tool for facilitating various financial transactions. VDRs play a critical function in:

M&A Transactions: VDRs play a crucial function in facilitating due diligence, streamlining communication, and ensuring data security.

During an M&A transaction, due diligence is a crucial stage where potential buyers meticulously review the target company’s financial records, contracts, and other pertinent documents to assess its value and determine potential risks. VDRs facilitate this process by:

- Centralizing and securing all due diligence documents: VDRs offer a secure platform for storing and sharing all pertinent information, ensuring that both parties have access to the necessary documents.

- Streamlining communication and collaboration: VDRs offer a centralized platform for communication, allowing all stakeholders to interact, ask querys, and share updates in a secure and efficient manner.

- Improving transparency and accountability: VDRs offer an audit trail of all document access and interactions, fostering transparency and accountability throughout the due diligence process.

Investment Banking: VDRs enable efficient deal management, investor relations, and secure document sharing.

VDRs are widely used in investment banking to manage complex deals, facilitate investor relations, and ensure secure document sharing. Key applications include:

- Deal management: VDRs offer a centralized platform for managing deal flow, tracking progress, and sharing information with stakeholders throughout the deal lifecycle.

- Investor relations: VDRs enable investment bankers to securely share deal materials with potential investors, facilitating the fundraising process and fostering transparency.

- Capital raising: VDRs offer a secure and efficient way to manage investor communications, track paid accesss, and manage the capital raising process.

Private Equity: VDRs are vital for fund management, portfolio monitoring, and transaction execution.

Private equity firms rely on VDRs to manage their investment portfolios, monitor portfolio companies, and execute transactions. Key uses include:

- Fund management: VDRs offer a centralized platform for organizing investment documents, tracking fund performance, and reporting to investors.

- Portfolio monitoring: VDRs allow private equity firms to securely access data from portfolio companies, facilitating due diligence, performance examination, and ongoing monitoring.

- Exit strategies: VDRs play a vital function in facilitating the sale of portfolio companies, managing transaction processes, and ensuring secure information exchange with potential buyers.

The benefits of Using VDRs in Financial Transactions

The use of VDRs in financial transactions brings numerous benefits, including:

Enhanced Security: VDRs offer a secure platform for storing and sharing sensitive financial data, minimizing the risk of data breaches.

VDRs employ advanced security attributes, such as encryption, multi-factor authentication, and access control mechanisms, to protect sensitive financial data from unauthorized access and breaches. This heightened security ensures the integrity and confidentiality of financial information, which is paramount in the financial sector.

Improved Efficiency: VDRs streamline workflows, reduce administrative burdens, and accelerate transaction timelines.

By eliminating the need for physical document storage and retrieval, VDRs streamline workflows and significantly reduce administrative burdens. The centralized platform fosters efficient collaboration among internal teams, external stakeholders, and advisors, accelerating transaction timelines and improving overall efficiency.

boostd Collaboration: VDRs facilitate seamless collaboration among internal teams, external stakeholders, and advisors.

VDRs offer a secure and accessible platform for teams to collaborate, share information, and communicate effectively throughout a transaction. This enhanced collaboration improves communication, reduces misunderstandings, and accelerates the decision-making process.

Cost Savings: VDRs reduce the cost associated with traditional data rooms, including printing, travel, and storage.

VDRs offer significant cost savings compared to traditional physical data rooms. By eliminating the need for printing, physical storage, and travel, VDRs reduce administrative overhead and streamline operations, leading to significant cost savings.

Use Cases of VDRs in Financial Transactions

VDRs are versatile tools with a wide scope of applications in financial transactions, including:

Mergers & Acquisitions (M&A):

- Due Diligence: VDRs facilitate the secure sharing of financial statements, contracts, and other critical documents during the due diligence process. This ensures that all pertinent information is readily accessible to both parties involved in the transaction.

- Negotiations: VDRs offer a centralized platform for communication and document exchange between parties involved in M&A negotiations. This platform facilitates efficient communication, track progress, and ensure transparency.

- Closing: VDRs streamline the closing process by providing a secure platform for managing the finalization of the transaction and the transfer of ownership.

Investment Banking:

- Deal Management: VDRs enable investment banks to manage deal flow efficiently, track progress, and share information with stakeholders throughout the deal lifecycle.

- Investor Relations: VDRs offer a secure platform for investment bankers to share deal materials with potential investors, facilitating fundraising and fostering transparency.

- Capital Raising: VDRs are crucial for managing investor communications, tracking paid accesss, and managing the capital raising process.

Private Equity:

- Fund Management: VDRs offer a centralized platform for organizing investment documents, tracking fund performance, and reporting to investors. This ensures transparency and efficient fund management.

- Portfolio Monitoring: VDRs allow private equity firms to securely access data from portfolio companies, facilitating due diligence, performance examination, and ongoing monitoring.

- Exit Strategies: VDRs play a vital function in facilitating the sale of portfolio companies, managing transaction processes, and ensuring secure information exchange with potential buyers.

Choosing the Right VDR for Your Financial Needs

When choosing a VDR for financial transactions, several factors must be considered to ensure a achievementful implementation:

- Security attributes: The security attributes of a VDR are paramount, and financial institutions should prioritize platforms with robust encryption, multi-factor authentication, and granular access control.

- User interface: The VDR’s user interface should be intuitive and easy to navigate, enabling all stakeholders to access and utilize the platform effectively.

- Integration capabilities: The VDR should integrate seamlessly with existing financial systems and software to streamline workflows and avoid data silos.

- Pricing: The pricing model should be transparent and align with the institution’s budget and application needs.

- Customer support: Reliable customer support is essential to address any technical issues or queries that may arise.

Industry-Specific VDRs: Options tailored to the unique requirements of the financial sector.

Several VDR offerrs specialize in serving the financial sector, offering attributes and functionalities tailored to the unique needs of financial institutions. These industry-specific VDRs often include attributes such as:

- Compliance with regulatory standards: The VDR complies with pertinent regulatory standards and optimal practices for handling financial data.

- Integration with financial systems: The VDR integrates seamlessly with existing financial systems and software, simplifying data exchange and workflow management.

- Advanced security measures: The VDR employs advanced security measures, such as encryption, multi-factor authentication, and access control, to protect sensitive financial data.

Evaluating VDR offerrs: Comparing attributes, pricing, and customer reviews to select the optimal fit.

Evaluating potential VDR offerrs involves comparing attributes, pricing, and customer reviews to determine the optimal fit for your organization’s needs. Some essential factors to consider include:

- attributes and functionalities: The VDR should offer the attributes and functionalities necessary to meet your specific needs, such as secure document sharing, audit trails, and access control.

- Pricing and paid access models: The pricing should be transparent and align with your budget, and the paid access model should be flexible enough to accommodate your application needs.

- Customer reviews and reputation: Check customer reviews and the offerr’s reputation to assess their reliability, customer support, and overall track record.

Conclusion

The rise of Virtual Data Rooms (VDRs) has revolutionized the financial sector, transforming how M&A transactions and other complex financial operations are conducted. VDRs offer unparalleled security, efficiency, and collaboration benefits, making them an indispensable tool for financial institutions and investors alike. By understanding the key attributes, benefits, and use cases of VDRs, financial professionals can leverage this technology to streamline processes, reduce risks, and achieve better business outcomes.