- What’s Inside a Virtual Data Room? An Insider's Look

- What is a Virtual Data Room?

- How does a Virtual Data Room work?

- Who uses a Virtual Data Room?

- What are the benefits of using a Virtual Data Room?

- Virtual Data Room attributes

- Virtual Data Rooms in the Due Diligence Process

- Why are Virtual Data Rooms used for due diligence?

- How does a Virtual Data Room streamline the due diligence process?

- What are the key benefits of using a Virtual Data Room for due diligence?

- Choosing the Right Virtual Data Room offerr

- What factors should you consider when choosing a Virtual Data Room offerr?

- How do you evaluate the security attributes of a Virtual Data Room offerr?

- What are the common pricing models for Virtual Data Rooms?

- Conclusion

Imagine a secure, online space where sensitive documents, contracts, and financial records are stored, organized, and accessible only to authorized individuals. This is the essence of a virtual data room (VDR), a crucial tool in various industries, from mergers & acquisitions (M&A) to real estate transactions, intellectual property management, and beyond. But what’s truly inside a VDR?

Think of it as a digital vault, not just for storing documents, but for managing complex workflows. You can upload, index, and categorize all types of files – from PDFs and Word documents to presentations, spreadsheets, images, and even videos. These documents are securely encrypted and protected with granular access control. Only designated individuals with the appropriate permissions can access specific documents or folders.

This robust security ensures confidentiality and peace of mind, a paramount consideration in sensitive transactions. The VDR itself operates on a robust infrastructure with features like audit trails, secure communication channels, and robust security protocols. Imagine having an unparalleled level of transparency throughout the entire process. With a VDR, every action is tracked, timestamped, and auditable, leaving no room for uncertainty or doubt.

This meticulous tracking and accountability ensure a smooth, efficient workflow that streamlines the entire process, giving everyone involved a clear view of the data and its evolution. So, whether you’re an investor scrutinizing financial reports, a legal team reviewing contracts, or a company embarking on a major deal, the VDR acts as a central hub, bringing order to the information chaos.

In the following sections, we’ll delve deeper into the intricate workings of a VDR, examining its key features, functionalities, and real-world applications. By understanding the nuances of a VDR, you can gain a deeper appreciation of its power as a valuable tool for efficient, secure, and transparent collaboration.

What’s Inside a Virtual Data Room? An Insider's Look

In the world of business, especially during mergers and acquisitions (M&A) or other high-stakes transactions, information is power. A secure and efficient way to manage and share sensitive data is crucial for achievement. This is where the Virtual Data Room (VDR) comes in.

What is a Virtual Data Room?

A Virtual Data Room is essentially a secure online platform that allows businesses to share and manage confidential documents and information during transactions. It’s like a digital vault with advanced security attributes, specifically designed for due diligence, transactions, and other sensitive data exchange activities.

How does a Virtual Data Room work?

A VDR works by providing a centralized, cloud-based repository for sensitive information. It acts as a secure hub for sharing documents and facilitating communication between parties involved in a transaction. Users can access and download documents, track activity, and even collaborate on documents within the platform.

Who uses a Virtual Data Room?

VDRs are used across various industries and for multiple purposes, but they are most commonly used in:

- Mergers and Acquisitions (M&A): During a merger or acquisition, the buyer’s team needs to conduct due diligence, and the VDR offers a secure platform for sharing the target company’s financials, legal documents, and other pertinent data.

- Private Equity and Venture Capital Transactions: Private equity and venture capital firms use VDRs to manage deal flow, share investment proposals, and conduct due diligence on potential investments.

- Real Estate Transactions: VDRs are also used in real estate transactions to share property documents, financial statements, and other pertinent information with potential buyers or investors.

- Intellectual Property Licensing and Management: Businesses can utilize VDRs to securely share intellectual property (IP) assets with potential licensees or collaborators, facilitating the licensing process.

What are the benefits of using a Virtual Data Room?

Using a VDR offers numerous benefits, including:

- Enhanced Security: VDRs employ advanced security attributes such as multi-factor authentication, encryption, and access control, ensuring the confidentiality and integrity of sensitive data.

- Streamlined Collaboration: VDRs facilitate seamless collaboration among stakeholders, allowing them to share and access documents, track progress, and communicate effectively.

- Improved Efficiency: VDRs automate tasks and streamline processes, saving time and resources compared to traditional methods of document sharing.

- boostd Transparency: VDRs offer clear audit trails and activity logs, providing transparency and accountability throughout the transaction process.

Virtual Data Room attributes

VDRs come equipped with a wide scope of attributes designed to enhance security, collaboration, and efficiency during data exchange:

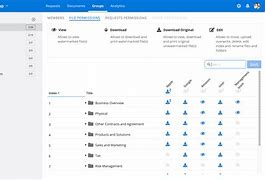

Security and Access Control

- function-based access control: varied users are granted varied levels of access based on their function and responsibilities, preventing unauthorized access.

- Watermarking: Sensitive documents can be watermarked with user information, allowing for easy tracking and preventing unauthorized distribution.

- Encryption: Data is encrypted both in transit and at rest, ensuring its confidentiality and integrity.

- Auditing and logging: VDRs track user activity, providing a thorough audit trail for regulatory compliance and legal purposes.

File Organization and Management

- Centralized repository: VDRs act as a single source of truth for all pertinent documents, providing a clear and organized system for accessing and managing information.

- Version control: Changes to documents are tracked and managed, ensuring that all users are working with the most up-to-date information.

- Metadata management: VDRs allow for tagging and categorizing documents, facilitating easy search and retrieval.

- Bulk upload and download: Users can upload and download multiple documents at once, saving time and effort.

Collaboration and Communication Tools

- Secure messaging: VDRs offer a secure messaging system for communication between parties involved in the transaction.

- Document annotation: Users can annotate and highlight documents, facilitating discussions and collaboration.

- Online meetings and webinars: Some VDRs offer integrated video conferencing and webinar capabilities for virtual meetings.

Due Diligence Workflow

- Task management: VDRs allow for the creation and assignment of tasks related to due diligence, ensuring efficient workflow management.

- Deadline tracking: VDRs offer reminders and alerts for deadlines, preventing delays and ensuring timely completion of tasks.

- query and answer (Q&A) functionality: VDRs offer a secure platform for asking and answering querys related to documents and the transaction.

Reporting and Analytics

- Activity reports: VDRs generate reports on user activity, providing insights into document access, download trends, and overall engagement.

- Customizable dashboards: Users can create personalized dashboards to monitor key metrics and track progress.

Virtual Data Rooms in the Due Diligence Process

VDRs play a crucial function in streamlining the due diligence process, which is the critical stage where potential buyers thoroughly examine a target company’s financial statements, legal documents, and other pertinent information to assess its value and risks.

Why are Virtual Data Rooms used for due diligence?

- Security: VDRs offer the highest level of security to protect sensitive information, ensuring that only authorized personnel have access to the data.

- Organization: VDRs offer a centralized repository for all pertinent documents, making it easy for due diligence teams to find and access the information they need.

- Collaboration: VDRs facilitate collaboration between the buyer’s team, the seller’s team, and other advisors, allowing them to share information and ask querys efficiently.

- Efficiency: VDRs streamline the due diligence process by automating tasks and providing tools for efficient document management and communication.

How does a Virtual Data Room streamline the due diligence process?

- Centralized access: VDRs allow all stakeholders to access the same information from a single platform, eliminating the need for multiple copies and reducing the risk of errors.

- Faster communication: VDRs offer secure messaging and Q&A functionality, allowing for quick and efficient communication between parties involved in the due diligence process.

- Improved workflow: VDRs offer task management tools, deadlines, and activity tracking to ensure that the due diligence process is completed efficiently and on time.

What are the key benefits of using a Virtual Data Room for due diligence?

- Reduced risk: VDRs minimize the risk of data breaches and unauthorized access, protecting sensitive information throughout the due diligence process.

- boostd speed and efficiency: VDRs streamline the due diligence process, allowing for faster and more efficient completion of the transaction.

- Improved communication and collaboration: VDRs facilitate seamless communication and collaboration between parties involved in the transaction.

- Enhanced transparency and accountability: VDRs offer clear audit trails and activity logs, ensuring transparency and accountability throughout the due diligence process.

Choosing the Right Virtual Data Room offerr

Choosing the right VDR offerr is crucial for ensuring a secure and efficient transaction process. There are several factors to consider when making this decision:

What factors should you consider when choosing a Virtual Data Room offerr?

- Security attributes: The VDR offerr should offer robust security attributes such as multi-factor authentication, encryption, and access control.

- User interface and functionality: The VDR platform should be easy to use and offer the necessary attributes to support your specific needs.

- Pricing models: VDR offerrs typically offer varied pricing models based on the size of the project, the number of users, and the duration of the project.

- Customer support: It’s crucial to select a offerr with responsive and reliable customer support.

- Industry experience: Look for a VDR offerr with experience in your industry to ensure that they understand your specific requirements.

How do you evaluate the security attributes of a Virtual Data Room offerr?

- Certifications: Check if the offerr has pertinent security certifications, such as ISO 27001 or SOC 2.

- Data encryption: Ensure that the offerr uses strong encryption algorithms to protect data both in transit and at rest.

- Access control: The offerr should offer function-based access control to limit access to sensitive information based on user functions.

- Audit trails: The offerr should offer thorough audit trails to track user activity and ensure accountability.

What are the common pricing models for Virtual Data Rooms?

- Per-user pricing: The cost is based on the number of users who will access the VDR.

- Per-gigabyte pricing: The cost is based on the amount of data stored in the VDR.

- Flat-fee pricing: A fixed fee is charged for a specific period of time, regardless of the number of users or the amount of data stored.

Conclusion

Virtual Data Rooms have become indispensable tools for businesses seeking to manage and share sensitive information securely and efficiently, especially during transactions. By offering advanced security attributes, streamlined collaboration tools, and a thorough scope of functionality, VDRs have revolutionized the way businesses handle sensitive data, ensuring a secure and achievementful transaction process. When choosing a VDR offerr, it’s crucial to consider factors such as security attributes, functionality, pricing, and customer support. By selecting the right VDR offerr, businesses can leverage the power of this technology to streamline their transactions, improve collaboration, and safeguard sensitive information.