- Boosting Investor Confidence: How Virtual Data Rooms Streamline Due Diligence

- What is Investor Confidence?

- Key Drivers of Investor Confidence

- Why is Investor Confidence crucial?

- The function of Due Diligence in Investor Confidence

- Understanding Due Diligence

- Due Diligence and Investor Confidence

- The Challenges of Traditional Due Diligence

- Virtual Data Rooms: A Modern Solution for Investor Confidence

- What are Virtual Data Rooms (VDRs)?

- How VDRs Streamline Due Diligence

- VDRs and Investor Confidence

- Key attributes of VDRs that Boost Investor Confidence

- optimal Practices for Using VDRs to Build Investor Confidence

- Real-World Examples: How VDRs Have Impacted Investor Confidence

- Conclusion

- VDRs: A Powerful Tool for Building Investor Confidence

- The Future of Due Diligence: VDRs as the industry standard for efficient and secure transactions.

- Call to Action: Start leveraging VDRs to enhance your fundraising and investor relations.

In the realm of mergers and acquisitions, investor confidence is paramount. It’s the cornerstone of successful deals, driving swift negotiations and favorable outcomes. But how do you inspire this confidence, especially when you’re dealing with sensitive and confidential data? Enter virtual data rooms (VDRs). VDRs are cloud-based platforms that act as secure digital repositories for due diligence documents. They revolutionize the M&A process, enabling investors to access critical information in a safe & controlled environment.

Think of a VDR as a virtual vault, where every piece of information is securely stored, encrypted, and accessible only to authorized personnel. With features like granular access controls, audit trails, and watermarks, VDRs ensure the integrity of your data. This is where the magic of investor confidence comes into play. Imagine a potential investor being able to seamlessly browse through your financial statements, contracts, and other relevant documents – all from the comfort of their own devices, without compromising security.

The transparency offered by VDRs allows investors to perform comprehensive due diligence, fostering a sense of trust & facilitating a smooth deal flow. It’s not just about the security, but also the efficiency VDRs bring to the table. By streamlining the due diligence process, you can significantly accelerate your M&A timeline, enabling quicker decisions & ultimately, a faster close. The ability to work collaboratively on VDRs, with multiple parties accessing information concurrently, further streamlines the process, enhancing efficiency and fostering stronger investor relationships.

But the advantages of using a VDR go beyond the M&A landscape. They can be invaluable for various corporate functions such as shareholder communication, project management, and regulatory compliance. The bottom line is, VDRs are not just platforms – they are strategic tools that empower you to cultivate investor confidence, unlock valuable opportunities, and achieve your business goals.

Boosting Investor Confidence: How Virtual Data Rooms Streamline Due Diligence

In the rival world of finance, securing investor confidence is crucial for any company seeking funding. A robust investor relationship built on trust and transparency is paramount to achieving fundraising objectives, securing favorable valuations, and ultimately driving long-term achievement.

What is Investor Confidence?

Defining investor confidence means understanding what makes an investor comfortable with placing their capital in a particular venture. It’s a multifaceted idea encompassing a scope of factors, including:

- Understanding the investment chance: Investors need a clear grasp of the company’s business model, industry position, and growth potential.

- Trust in the management team: Investors seek confidence in the leadership’s capabilities, experience, and integrity.

- Confidence in the company’s financial health: A strong track record of performance, sound financial management, and a clear financial plan inspire investor confidence.

Key Drivers of Investor Confidence

Several key factors influence investor decisions and contribute to their overall confidence level:

- industry trends: Favorable industry conditions, economic stability, and positive industry sentiment can fuel investor enthusiasm.

- Company performance: Strong financial outcomes, consistent revenue growth, and a achievementful track record of execution all bolster investor confidence.

- rival landscape: A company’s position within its industry, its rival benefits, and its ability to navigate industry challenges are crucial factors.

- Regulatory environment: A stable and predictable regulatory framework fosters investor confidence, as it reduces uncertainties and risks.

Why is Investor Confidence crucial?

Investor confidence is not merely a theoretical idea; it has tangible and direct implications for a company’s achievement:

- Fundraising: High investor confidence translates into easier access to capital, potentially leading to larger funding rounds at favorable terms.

- Valuations: A company with a strong investor reputation can command higher valuations, reflecting a premium on its perceived value and potential.

- Long-term achievement: A solid base of confident investors offers stability, support, and valuable connections, all of which contribute to sustained growth and achievement.

The function of Due Diligence in Investor Confidence

Due diligence, the process of meticulously investigating a potential investment, plays a crucial function in building investor confidence.

Understanding Due Diligence

Due diligence involves a thorough examination of a company’s financials, operations, legal structure, management team, and industry position. Investors seek to understand:

- Financial health: Examining financial statements, cash flow, and debt levels to assess the company’s financial stability and profitability.

- Operations: Assessing the company’s efficiency, scalability, and key operational processes.

- Legal and regulatory compliance: Verifying the company’s compliance with pertinent laws and regulations to minimize potential risks.

- Management team: Evaluating the leadership’s experience, skills, and track record to assess their ability to steer the company towards achievement.

- industry chance: Assessing the size, growth potential, and rival landscape of the target industry.

Due Diligence and Investor Confidence

Due diligence serves as a critical step in fostering trust and reducing risk for investors. A thorough and transparent due diligence process:

- Builds trust: Demonstrating openness and willingness to offer information fosters trust and confidence in the investment chance.

- Reduces risk: By determineing potential challenges and mitigating risks upfront, investors can make more informed and confident investment decisions.

- Enhances transparency: A thorough due diligence process showcases the company’s commitment to transparency and good governance.

The Challenges of Traditional Due Diligence

Traditional due diligence methods often present challenges, hindering efficiency and potentially impacting investor confidence:

- Inefficiencies: Physical document sharing, lengthy review processes, and manual data management can lead to delays and inefficiencies.

- Time constraints: The time-consuming nature of traditional due diligence can delay investment decisions and frustrate both parties.

- Security concerns: Sharing sensitive documents through traditional methods raises concerns about data security and confidentiality.

Virtual Data Rooms: A Modern Solution for Investor Confidence

Virtual data rooms (VDRs) have emerged as a modern and innovative solution to address the challenges of traditional due diligence.

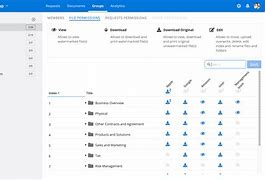

What are Virtual Data Rooms (VDRs)?

VDRs are secure, cloud-based platforms specifically designed for sharing and managing sensitive documents during due diligence processes. They offer a centralized and secure environment for:

- Document storage: Storing all pertinent documents, including financial statements, legal documents, and operational reports, in a single, secure location.

- Secure access control: Granting authorized users controlled access to specific documents and folders based on their functions and responsibilities.

- Real-time collaboration: Facilitating seamless communication and collaboration among all stakeholders involved in the due diligence process.

How VDRs Streamline Due Diligence

VDRs significantly enhance the due diligence process by:

- Improving efficiency: VDRs streamline document sharing, review, and communication, reducing the time and effort involved in due diligence.

- Boosting security: Advanced security attributes such as data encryption, access control, and audit trails ensure the confidentiality and integrity of sensitive information.

- Simplifying document management: VDRs offer robust document organization tools, advanced search capabilities, and version control, making it easier for investors to locate and review necessary information.

VDRs and Investor Confidence

The adoption of VDRs demonstrates a company’s commitment to transparency and professionalism, boosting investor confidence in several ways:

- Transparency: VDRs offer a clear and readily accessible platform for investors to access all pertinent documentation, fostering a sense of transparency and openness.

- Efficiency: The streamlined due diligence process facilitated by VDRs showcases the company’s efficiency and commitment to timely execution.

- Security: The robust security attributes of VDRs assure investors that their sensitive information is safe and protected throughout the due diligence process.

Key attributes of VDRs that Boost Investor Confidence

VDRs are equipped with a scope of attributes that directly contribute to investor confidence:

Security:

- Data encryption: All documents are encrypted both at rest and in transit, safeguarding sensitive information from unauthorized access.

- Access control: Granular access controls allow for precise control over who can view, edit, or download specific documents or folders.

- Audit trails: Detailed logs track all user activity, providing a clear record of who accessed what documents and when.

User-Friendliness:

- Intuitive interfaces: VDR platforms are designed with user-friendly interfaces that are easily navigable and accessible to users of all technical backgrounds.

- Mobile access: VDRs offer mobile compatibility, allowing investors to access documents and collaborate on the go.

- Seamless document sharing: Effortless document sharing facilitates quick and efficient distribution of information among stakeholders.

Organization and Accessibility:

- Streamlined document organization: VDRs offer sophisticated document organization attributes, enabling users to create clear folder structures and categorize documents effectively.

- Advanced search capabilities: Powerful search functions allow investors to quickly locate specific documents and information within the data room.

- Controlled access: Access levels can be customized to ensure only authorized individuals can view specific documents.

Collaboration and Communication:

- Real-time document collaboration: VDRs allow multiple users to collaborate on documents simultaneously, facilitating efficient and timely reviews.

- Communication tools: Built-in communication tools, such as secure messaging and Q&A forums, enable direct and secure communication among stakeholders.

optimal Practices for Using VDRs to Build Investor Confidence

To maximize the impact of VDRs on investor confidence, companies should adhere to these optimal practices:

Preparing Your Data Room:

- Organizing documents: Ensure a clear and logical folder structure, categorizing documents according to their relevance and type.

- Creating clear folders: Use descriptive and intuitive folder names to help investors easily navigate the data room.

- Ensuring accuracy: Review all documents thoroughly to ensure accuracy and completeness, minimizing the risk of errors or omissions.

Engaging with Investors:

- Providing clear instructions: Offer thorough instructions on navigating the VDR platform and accessing pertinent documents.

- Setting up access levels: Establish appropriate access levels based on the functions and responsibilities of each investor.

- Being responsive to queries: Promptly address investor querys and concerns, demonstrating a commitment to transparency and communication.

Maintaining Transparency:

- Openly addressing querys and concerns: offer clear and detailed responses to investor inquiries, fostering a sense of trust and openness.

- Providing detailed information: Offer thorough information on the company’s operations, financials, and future plans to build confidence and demonstrate transparency.

Real-World Examples: How VDRs Have Impacted Investor Confidence

Case Study 1:

A young startup, seeking funding for its innovative technology, utilized a VDR to streamline the due diligence process. By providing investors with organized access to all pertinent documents, the startup demonstrated transparency and efficiency. This ultimately led to a achievementful fundraising round, exceeding the company’s initial target.

Case Study 2:

A mature company with a strong track record sought to expand its operations through a strategic acquisition. They employed a VDR to facilitate a smooth and secure due diligence process with the target company. The VDR’s robust security attributes reassured the acquiring company’s investors, contributing to a achievementful acquisition and investor satisfaction.

Conclusion

Virtual data rooms have transformed the due diligence landscape, offering a powerful tool for building investor confidence.

VDRs: A Powerful Tool for Building Investor Confidence

By streamlining the due diligence process, enhancing transparency, and ensuring data security, VDRs empower companies to effectively address investor concerns and build trust.

The Future of Due Diligence: VDRs as the industry standard for efficient and secure transactions.

VDRs are rapidly becoming the industry standard for due diligence, revolutionizing the way investors evaluate investment opportunities. The benefits they offer in terms of efficiency, security, and transparency are reshaping the investor landscape, paving the way for more informed and confident investment decisions.

Call to Action: Start leveraging VDRs to enhance your fundraising and investor relations.

Companies seeking to attract investors and secure funding should embrace VDRs as a strategic tool. By embracing this technology, companies can streamline due diligence, build trust, and ultimately achieve their fundraising objectives. The future of investor relations is built on transparency, efficiency, and security, and VDRs are at the forefront of this evolution.