- How Virtual Data Rooms Are Transforming Due Diligence

- What is a Virtual Data Room?

- What is a virtual data room used for?

- Why are virtual data rooms crucial?

- The Traditional Due Diligence Process

- The Challenges of the Traditional Due Diligence Process

- How Virtual Data Rooms are Transforming Due Diligence

- The benefits of Using a Virtual Data Room for Due Diligence

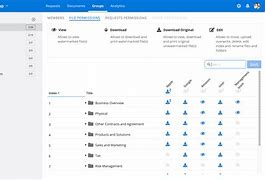

- Key attributes of Virtual Data Rooms

- benefits of Virtual Data Rooms for Mergers and Acquisitions (M&A)

- The Future of Virtual Data Rooms in Due Diligence

- The Impact of Technology on Due Diligence

- The Future of Due Diligence in the Digital Age

- The Future of Virtual Data Rooms

- Choosing the Right Virtual Data Room offerr

- Factors to Consider When Choosing a Virtual Data Room offerr

- crucial attributes to Look For

- How to Assess the Security of a Virtual Data Room offerr

- Key querys to Ask Potential offerrs

- Conclusion

Due diligence is a crucial step in any merger & acquisition deal, involving a comprehensive evaluation of a target company. Traditionally, this process has been cumbersome & time-consuming, requiring physical exchange of large volumes of documents. However, the emergence of virtual data rooms (VDRs) has revolutionized the due diligence process, streamlining it and significantly improving efficiency.

A VDR is essentially a secure online platform where sensitive company data is stored & shared during the due diligence phase. It provides a centralized location for all due diligence materials, enabling seamless access & collaboration between the parties involved. With features like controlled access, version control, and activity tracking, VDRs enhance transparency, accountability, & security throughout the entire process.

Let’s explore how VDRs are transforming due diligence & the significant benefits they bring to the table. We’ll examine the key features & functionalities of these platforms, shedding light on how they’ve become indispensable tools for M&A transactions. Get ready to delve into the world of virtual data rooms and discover how they are shaping the future of due diligence.

How Virtual Data Rooms Are Transforming Due Diligence

In today’s fast-paced business environment, efficiency and security are paramount. When it comes to mergers and acquisitions (M&A), due diligence is a crucial step that requires meticulous scrutiny of a target company’s financial records, operations, and legal documents. Traditional methods of due diligence often involve cumbersome paper-based processes, leading to delays, inefficiencies, and security concerns.

Enter virtual data rooms (VDRs) – a revolutionary solution that is transforming the way due diligence is conducted. VDRs are secure online platforms that facilitate the storage, sharing, and management of sensitive documents during M&A transactions.

What is a Virtual Data Room?

A virtual data room (VDR) is essentially a secure online repository where companies can store and share sensitive documents with authorized parties during due diligence, mergers, acquisitions, or other business transactions. It offers a centralized platform for managing and tracking all pertinent documents, ensuring that all stakeholders have access to the information they need in a secure and controlled environment.

What is a virtual data room used for?

VDRs are primarily used for:

- Due diligence: Providing potential buyers with access to a company’s financial statements, contracts, legal documents, and other sensitive information.

- M&A transactions: Facilitating the secure exchange of documents and communication between parties during mergers and acquisitions.

- Fundraising: Presenting investors with detailed information about a company’s business plan, financials, and industry examination.

- Legal discovery: Providing access to pertinent documents during legal proceedings.

- Other business transactions: Sharing sensitive information with partners, vendors, or customers.

Why are virtual data rooms crucial?

VDRs are crucial for conducting due diligence effectively and efficiently. They offer several benefits over traditional methods, including:

- Enhanced security: VDRs offer a secure and controlled environment for storing and accessing sensitive documents, protecting them from unauthorized access and data breaches.

- Improved collaboration: VDRs facilitate seamless communication and collaboration between all stakeholders, regardless of their location, enabling teams to work together more effectively.

- boostd efficiency: VDRs streamline the due diligence process by providing a centralized platform for document management, eliminating the need for physical document handling and reducing delays.

- Reduced costs: VDRs eliminate the costs associated with physical storage, transportation, and printing, making the due diligence process more cost-effective.

The Traditional Due Diligence Process

Before the advent of VDRs, due diligence was a tedious and time-consuming process. It involved:

- Physical document storage: Documents were stored in physical file cabinets, requiring significant space and resources.

- Manual document retrieval: Retrieving specific documents involved searching through stacks of paper, which could be inefficient and time-consuming.

- In-person meetings: Parties involved in due diligence had to meet in person to share and review documents, leading to travel expenses and scheduling conflicts.

- Limited security: Physical documents were vulnerable to loss, damage, or theft, posing a significant security risk.

The Challenges of the Traditional Due Diligence Process

The traditional due diligence process presented several challenges, including:

- Slow turnaround time: The manual nature of the process led to significant delays in completing due diligence.

- Limited access: Access to documents was restricted to those physically present at the location where the documents were stored.

- boostd costs: The need for physical document storage, transportation, and in-person meetings contributed to high costs.

- Security risks: Physical documents were vulnerable to loss, damage, or theft, posing a significant security risk.

How Virtual Data Rooms are Transforming Due Diligence

VDRs have revolutionized the due diligence process by addressing the challenges of traditional methods and providing a secure, efficient, and collaborative platform for managing sensitive information. Here are some key ways that VDRs are transforming due diligence:

- boostd Efficiency and Speed: VDRs streamline the due diligence process by providing a centralized platform for document management, allowing all stakeholders to access the information they need quickly and easily. This eliminates the need for physical document handling, reducing delays and speeding up the entire process.

- Enhanced Security and Control: VDRs offer robust security attributes, such as encryption, access control, and audit trails, ensuring that sensitive information is protected from unauthorized access and data breaches. They also allow for granular permissions, enabling users to control who can view, edit, or download specific documents.

- Improved Collaboration and Communication: VDRs facilitate seamless communication and collaboration between all parties involved in due diligence, regardless of their location. They allow for real-time document sharing, commenting, and annotation, enabling teams to work together more effectively.

- Reduced Costs: VDRs eliminate the need for physical storage, transportation, and printing, making the due diligence process more cost-effective. They also reduce travel expenses by eliminating the need for in-person meetings.

The benefits of Using a Virtual Data Room for Due Diligence

Using a VDR for due diligence offers several benefits, including:

- Faster transaction completion: VDRs streamline the due diligence process, enabling transactions to close more quickly.

- Reduced risk: VDRs offer robust security attributes, mitigating the risks associated with storing and sharing sensitive information.

- Enhanced transparency: VDRs ensure that all stakeholders have access to the same information, promoting transparency and trust.

- Improved communication and collaboration: VDRs facilitate seamless communication and collaboration between all parties involved in due diligence.

- Streamlined due diligence process: VDRs automate many tasks associated with due diligence, streamlining the process and making it more efficient.

Key attributes of Virtual Data Rooms

VDRs offer a scope of attributes designed to enhance the due diligence process. Some key attributes include:

- Secure Document Storage and Access: VDRs offer a secure online repository for storing and accessing sensitive documents. They use encryption and access control to protect documents from unauthorized access.

- thorough Document Management Tools: VDRs offer a suite of tools for managing documents, including search, indexing, version control, and redaction.

- Advanced Security attributes: VDRs incorporate advanced security attributes, such as multi-factor authentication, audit trails, and watermarks, to prevent unauthorized access and ensure data integrity.

- Real-Time Collaboration Tools: VDRs offer real-time collaboration tools, such as commenting, annotation, and chat, enabling teams to work together effectively.

- Audit Trails and Reporting: VDRs record all user activity, providing an audit trail that can be used to track access to documents and determine potential security breaches. They also offer detailed reports on user activity, document access, and other key metrics.

benefits of Virtual Data Rooms for Mergers and Acquisitions (M&A)

VDRs offer significant benefits for M&A transactions, including:

- Faster Transaction Completion: VDRs streamline the due diligence process, enabling transactions to close more quickly.

- Reduced Risk: VDRs offer robust security attributes, mitigating the risks associated with storing and sharing sensitive information during M&A transactions.

- Enhanced Transparency: VDRs ensure that all stakeholders have access to the same information, promoting transparency and trust throughout the M&A process.

- Improved Communication and Collaboration: VDRs facilitate seamless communication and collaboration between all parties involved in M&A transactions, regardless of their location.

- Streamlined Due Diligence Process: VDRs automate many tasks associated with due diligence, streamlining the process and making it more efficient, which is crucial for M&A transactions.

The Future of Virtual Data Rooms in Due Diligence

VDRs are constantly evolving, with new technologies and attributes being introduced regularly. Here are some key trends shaping the future of VDRs:

- boostd Integration with Other Software: VDRs are increasingly being integrated with other software applications, such as CRM systems, accounting software, and project management tools. This integration offers a seamless and streamlined experience for users.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are being used to enhance VDR functionality, such as automated document indexing, search, and redaction. These technologies can significantly improve the efficiency and accuracy of due diligence.

- Cloud-Based Solutions: VDRs are increasingly being delivered as cloud-based solutions, offering users greater scalability, flexibility, and cost-efficacy.

- Enhanced Security attributes: VDR offerrs are constantly developing new security attributes to protect sensitive information, such as advanced encryption, biometrics, and multi-factor authentication.

The Impact of Technology on Due Diligence

Technology is revolutionizing the due diligence process. VDRs are just one example of how technology is transforming the way companies conduct due diligence. Other technologies, such as data analytics, blockchain, and artificial intelligence, are also having a significant impact on the field. These technologies are enabling companies to conduct due diligence more efficiently, effectively, and securely.

The Future of Due Diligence in the Digital Age

The future of due diligence lies in the digital age. Companies are increasingly embracing technology to streamline and enhance the due diligence process. VDRs and other technological advancements are making due diligence faster, more efficient, and more secure.

The Future of Virtual Data Rooms

VDRs are becoming increasingly sophisticated and attribute-rich, offering a wide scope of benefits for businesses. In the future, we can expect VDRs to become even more integrated with other software applications, incorporating AI and ML to further automate tasks, and offering even greater security attributes.

Choosing the Right Virtual Data Room offerr

selecting the right VDR offerr is essential for ensuring a smooth and achievementful due diligence process. When choosing a VDR offerr, it is crucial to consider the following factors:

- attributes: Consider the attributes offered by the VDR offerr, such as document management tools, security attributes, and collaboration capabilities.

- Security: Ensure that the VDR offerr has robust security attributes to protect sensitive information.

- Pricing: Compare the pricing models offered by varied VDR offerrs, ensuring that the price is rival and fits your budget.

- Customer Support: select a VDR offerr that offers excellent customer support, ensuring that you can get help when you need it.

Factors to Consider When Choosing a Virtual Data Room offerr

Here are some additional factors to consider when choosing a virtual data room offerr:

- Experience: select a VDR offerr with experience in serving companies in your industry.

- Reputation: select a VDR offerr with a good reputation for security, reliability, and customer service.

- Scalability: Ensure that the VDR offerr’s platform can scale to meet your future needs.

- Integration: Check to see if the VDR offerr’s platform integrates with your existing software applications.

crucial attributes to Look For

When evaluating VDR offerrs, look for the following essential attributes:

- Secure Document Storage and Access: Ensure that the VDR offerr offers robust security attributes, such as encryption, access control, and audit trails.

- Document Management Tools: Look for a VDR offerr that offers a thorough suite of document management tools, such as search, indexing, version control, and redaction.

- Collaboration Tools: select a VDR offerr that offers real-time collaboration tools, such as commenting, annotation, and chat.

- Audit Trails and Reporting: select a VDR offerr that offers detailed audit trails and reports on user activity, document access, and other key metrics.

How to Assess the Security of a Virtual Data Room offerr

To assess the security of a VDR offerr, ask the following querys:

- What encryption methods do you use?

- What access controls do you offer?

- How do you protect against data breaches?

- Do you have a disaster recovery plan?

- What certifications do you hold?

Key querys to Ask Potential offerrs

Here are some additional key querys to ask potential VDR offerrs:

- What is your pricing model?

- What level of customer support do you offer?

- What is your experience in serving companies in my industry?

- What are your data retention policies?

- Do you offer any integrations with other software applications?

Conclusion

Virtual data rooms are transforming due diligence, making it faster, more efficient, and more secure. By providing a secure and collaborative platform for managing sensitive documents, VDRs are helping companies conduct due diligence more effectively and complete transactions more quickly.

As technology continues to evolve, VDRs will become even more sophisticated and powerful, playing an increasingly crucial function in the due diligence process. By choosing the right VDR offerr and leveraging the attributes and benefits of VDRs, companies can streamline their due diligence process and enhance their overall M&A plan.