How Virtual Data Rooms Simplify the Investor Onboarding Process

In the competitive world of finance, every second counts. Investors want to make informed decisions swiftly, and companies need to present themselves effectively to secure funding. This is where virtual data rooms (VDRs) come into play. VDRs streamline the investor onboarding process by providing a secure and centralized platform for sharing vital documents & information, accelerating the decision-making process and reducing administrative burden.

Traditionally, investor onboarding involved the laborious task of manually assembling & sending physical documents. This process was time-consuming & prone to errors. Imagine sending countless hard copies through mail & waiting for confirmation. Not only was it inefficient, but it also posed security risks. VDRs revolutionized the process by introducing digital solutions that tackle these pain points effectively.

A VDR serves as a secure repository for all investor-related documentation, offering seamless access to crucial materials. Imagine having all your investor presentations, financial statements, due diligence reports, & legal documents accessible on a single platform – that’s the power of a VDR! With robust security features, such as controlled user permissions & robust encryption, VDRs ensure that sensitive information is protected. This reassures investors & allows them to review the documentation with confidence.

Furthermore, VDRs facilitate collaboration and accelerate the entire investor onboarding journey. Imagine inviting investors to access the data room, making them privy to specific information. You can customize access permissions based on user roles. This allows for streamlined due diligence, reduces communication back & forth & ensures a seamless workflow. VDR platforms provide real-time tracking of document activity, enabling teams to stay on top of progress & ensure timely responses to investors’ questions.

The efficiency & security offered by VDRs not only benefit investors but also provide a strategic advantage for businesses. In today’s fast-paced market, efficiency is crucial. VDRs make it possible to secure investments quicker, ultimately accelerating growth and driving business success. VDRs help you move beyond traditional onboarding processes & usher in a new era of streamlined & secure investor relations. So why wait? Start your journey towards seamless investor onboarding with a VDR & reap the rewards of efficient, secure, and streamlined investor relations today!

Streamlining Investor Onboarding: How Virtual Data Rooms Can Revolutionize Your Process

The investor onboarding process is a critical stage in any company’s journey. It involves attracting investors, presenting your business proposition, and ultimately securing funding. However, this process can often be complex, time-consuming, and riddled with inefficiencies. Enter virtual data rooms (VDRs) – powerful tools that are revolutionizing the way companies manage investor onboarding, making it faster, more secure, and far more streamlined.

What are Virtual Data Rooms?

Understanding the meaning: Define Virtual Data Rooms (VDRs) and their purpose.

Virtual data rooms are secure online platforms designed to manage and share sensitive documents and information. They are specifically tailored to facilitate due diligence processes, investor relations, and other critical business transactions. Think of a VDR as a secure digital vault, where you can store all your crucial documents, control access to them, and track every activity.

Key attributes and functionality: Explore the essential attributes of a VDR, including secure file storage, user access control, and document versioning.

VDRs are packed with attributes designed to enhance the investor onboarding process:

- Secure File Storage: VDRs offer robust encryption and security measures to protect your sensitive data from unauthorized access.

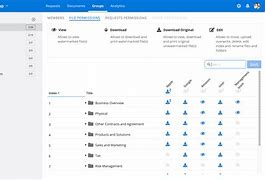

- User Access Control: You can grant specific access levels to varied users, ensuring only authorized individuals can view certain documents. This is crucial for maintaining confidentiality and compliance.

- Document Versioning: VDRs automatically track every change made to a document, providing a complete audit trail and ensuring all users are working with the most up-to-date information.

- Advanced Search and Filtering: Easily find specific documents within your VDR using advanced search filters, making it easy to locate the information you need.

- Electronic Signatures: VDRs allow for secure electronic signatures, streamlining the signing of crucial documents and eliminating the need for physical signatures.

- Collaboration Tools: Some VDRs offer collaboration attributes, allowing users to share comments and feedback directly on documents, improving communication and efficiency.

Why are VDRs crucial? Explain the benefits of using VDRs for investor onboarding, such as enhanced security, efficiency, and transparency.

VDRs are essential for streamlining investor onboarding because they offer significant benefits over traditional methods:

- Enhanced Security: VDRs protect sensitive data from unauthorized access, ensuring that only authorized individuals can view specific documents.

- boostd Efficiency: VDRs streamline the process, reducing the time and effort required for document sharing, communication, and due diligence.

- Improved Transparency: VDRs offer a transparent audit trail, allowing investors to track all document activity and access information readily.

The Investor Onboarding Process: A Traditional Approach

Traditional Challenges: Describe the complexities and inefficiencies of traditional investor onboarding methods, highlighting issues like manual paperwork, delays, and security concerns.

Traditionally, investor onboarding was a cumbersome and time-consuming process. It involved:

- Manual Paperwork: Investors often needed to sign physical documents and physically deliver them, which was time-consuming, prone to errors, and susceptible to loss or damage.

- Multiple Emails and Attachments: Sharing documents often involved sending numerous emails with large attachments, leading to inbox clutter and potential security risks.

- Security Concerns: Physical documents and email attachments are vulnerable to security breaches and data leaks.

- Delays: The manual process often outcomeed in delays, hindering the speed at which investors could access information and make decisions.

The Importance of Streamlining: Emphasize the need for a more efficient and streamlined investor onboarding process to attract and retain investors.

In today’s fast-paced business environment, investors expect a seamless and efficient onboarding process. A lengthy and complicated process can deter investors and outcome in missed opportunities. Streamlining the process is essential to attract and retain investors.

How VDRs Simplify Investor Onboarding

Centralized Document Repository: Discuss how VDRs act as a central hub for all investor-related documents, ensuring easy access and organization.

One of the key benefits of VDRs is their ability to act as a central repository for all investor-related documents. This eliminates the need to search through multiple emails and folders, ensuring all necessary information is readily available. Imagine a single, secure location where you can store all your investor pitch decks, financial statements, legal documents, and other pertinent materials. This centralized approach greatly simplifies the process, eliminating the frustration of searching for lost or misplaced documents.

Secure Access Control: Explain how VDRs enable granular user permissions and secure authentication, safeguarding sensitive information.

VDRs employ robust security measures to protect your data. They enable granular user permissions, meaning you can control who has access to specific documents and what level of access they have. For example, you can grant investors access to certain documents while restricting access to others that contain sensitive information. This granular control ensures that only authorized individuals can view specific information, safeguarding your company’s intellectual property and confidential data.

VDRs also utilize secure authentication protocols, such as two-factor authentication, to verify user identities and prevent unauthorized access. This ensures that only legitimate users can access your VDR and its sensitive information.

Automated Workflow and Communication: Explore the automated attributes of VDRs that streamline document sharing, track progress, and facilitate communication.

VDRs offer automated attributes that further streamline the investor onboarding process:

- Automated Document Sharing: VDRs allow you to share documents with investors directly from the platform, eliminating the need for manual email attachments. This ensures that everyone is working with the most up-to-date versions.

- Progress Tracking: VDRs offer real-time tracking of document access, allowing you to monitor investor activity and ensure timely completion of due diligence.

- Secure Communication: VDRs often include secure messaging attributes, allowing investors to communicate with your team directly within the platform. This centralizes all communication, ensuring nothing gets lost in the shuffle.

Enhanced Due Diligence: Explain how VDRs facilitate due diligence by providing investors with thorough access to pertinent documents and information.

Due diligence is a crucial step in the investor onboarding process. It involves investors thoroughly reviewing a company’s financials, operations, and legal documentation to assess investment risks and make informed decisions. VDRs streamline this process by:

- Providing easy access to all pertinent documents: VDRs allow investors to access all necessary documents in a secure and organized manner, facilitating efficient due diligence.

- Ensuring complete transparency: VDRs offer a thorough audit trail of document access, demonstrating transparency and building investor confidence.

- Enabling efficient communication: VDRs facilitate communication between investors and the company, allowing for quick clarification of querys and efficient resolution of issues.

The benefits of Using VDRs for Investor Onboarding

Faster and More Efficient: Highlight how VDRs accelerate the onboarding process, saving time and resources for both parties.

VDRs significantly accelerate the investor onboarding process. By eliminating manual paperwork, streamlining document sharing, and simplifying communication, VDRs save valuable time and resources for both investors and companies. This translates to faster decision-making, quicker funding cycles, and a more efficient overall investment process.

Improved Security and Compliance: Discuss how VDRs ensure data security, compliance with regulations, and investor confidence.

Data security is paramount in today’s business world, and VDRs excel in this area. Their robust security measures ensure that confidential information is protected from unauthorized access. This adherence to data security standards not only protects the company’s assets but also builds investor confidence, as they can be assured that their information is safe and secure.

Furthermore, VDRs often comply with industry regulations and standards, such as HIPAA or GDPR, ensuring that your data is handled in accordance with the pertinent legal frameworks. This helps companies avoid costly penalties and maintains investor trust.

Enhanced Communication and Collaboration: Explain how VDRs facilitate seamless communication and collaboration between investors and the company.

VDRs are more than just secure document repositories; they also foster better communication and collaboration. The platform’s secure messaging attributes allow investors to ask querys, share feedback, and collaborate with the company team in real-time. This seamless communication streamlines the process, reduces misunderstandings, and ensures that everyone is on the same page.

Reduced Costs and Paperwork: Discuss how VDRs eliminate the need for physical paperwork and reduce administrative costs.

VDRs contribute to significant cost savings by eliminating the need for physical paperwork. This reduces printing, mailing, and storage costs, leading to significant financial savings. Moreover, the automation of document sharing and communication processes also minimizes the need for administrative staff, further contributing to cost reduction.

selecting the Right VDR for Your Needs

Key Considerations: Guide readers through the process of choosing a VDR, highlighting factors like attributes, security, pricing, and customer support.

Choosing the right VDR is crucial for a achievementful investor onboarding experience. Here are some key factors to consider:

- attributes: Assess the attributes offered by varied VDR offerrs, ensuring they meet your specific needs. Look for attributes like secure file storage, user access control, document versioning, automated workflows, and communication tools.

- Security: Prioritize VDR offerrs with robust security attributes like encryption, two-factor authentication, and compliance with pertinent industry regulations.

- Pricing: Compare pricing models and ensure they fit within your budget. VDR offerrs often offer varied pricing tiers based on attributes and storage capacity.

- Customer Support: select a offerr with responsive and reliable customer support to address any querys or technical issues.

- Integrations: Consider whether the VDR offerr integrates with your existing systems and workflows.

- Ease of Use: Opt for a VDR that is user-friendly and easy to navigate for both you and your investors.

Popular VDR offerrs: Introduce some reputable VDR offerrs and their strengths.

Several reputable VDR offerrs offer a scope of solutions for investor onboarding, including:

- Intralinks: A leading VDR offerr known for its robust security attributes, advanced analytics, and thorough user management tools.

- Firmex: Offers a user-friendly platform with a focus on ease of use, advanced collaboration attributes, and strong security measures.

- Drooms: Specializes in secure document sharing, virtual data rooms, and investor communication tools, particularly for mergers and acquisitions.

- ShareFile: Offers a flexible and scalable VDR solution with attributes like secure file sharing, document versioning, and collaboration tools.

optimal Practices for Implementing a VDR

Offer tips for effectively implementing and integrating a VDR into your existing processes.

Implementing a VDR can significantly improve your investor onboarding process, but it’s crucial to do it right. Here are some optimal practices:

- Plan Thoroughly: Before implementing a VDR, define your needs, determine key stakeholders, and outline the processes you want to automate.

- Train Your Team: Ensure your team is fully trained on how to use the VDR platform and its various attributes.

- Start Small: Begin by implementing the VDR for a few specific processes before expanding its use gradually.

- Get Feedback: Regularly gather feedback from your team and investors to determine areas for improvement and optimization.

- Keep it Up-to-Date: Regularly update your VDR text, ensuring all documents are accurate and current.

- Monitor and Analyze: Track key metrics like document access, communication activity, and time to completion to measure the efficacy of your VDR implementation.

Conclusion

The Future of Investor Onboarding: Summarize how VDRs are transforming investor onboarding, leading to greater efficiency, security, and transparency.

VDRs are transforming the investor onboarding process, making it faster, more secure, and more efficient than ever before. By streamlining document sharing, automating workflows, and enhancing communication, VDRs are helping companies attract and retain investors, ultimately leading to more achievementful funding rounds. The future of investor onboarding lies in embracing these digital solutions, and those who do will reap the rewards of efficiency, security, and transparency.

Call to Action: Encourage readers to explore VDR solutions and experience the benefits of streamlined investor onboarding.

If you’re looking to streamline your investor onboarding process and gain a rival edge, it’s time to consider incorporating a VDR into your operations. Explore the various VDR offerrs available, select the solution that optimal suits your needs, and experience the transformative power of this technology. The benefits are undeniable – faster onboarding, boostd security, and greater efficiency, all contributing to a more achievementful and streamlined investor experience.