- How Virtual Data Rooms Streamline Corporate Governance

- What is a Virtual Data Room?

- benefits Beyond Due Diligence: VDRs are not just for mergers and acquisitions.

- How Virtual Data Rooms Improve Corporate Governance

- VDRs and Due Diligence: A Perfect Match

- VDRs for Various Corporate Governance facets

- Choosing the Right Virtual Data Room:

- Conclusion: Virtual Data Rooms – The Future of Corporate Governance

In today’s fast-paced business world, efficient communication & collaboration are paramount for successful corporate governance. Traditional methods of information sharing, such as email chains or physical file storage, often fall short in providing a secure and streamlined experience. This is where virtual data rooms (VDRs) come into play, revolutionizing the way organizations manage sensitive information, improve efficiency, and enhance transparency in their governance processes.

VDRs are essentially secure online platforms designed specifically for sharing, managing, and tracking confidential documents. Think of them as virtual equivalents of physical data rooms, but with a range of sophisticated features and benefits. Imagine having a centralized repository for all your crucial documents, with access controlled down to the individual user level, providing comprehensive audit trails for all activity. VDRs offer a powerful solution that not only optimizes corporate governance but also enhances stakeholder trust.

Beyond just secure document sharing, VDRs facilitate seamless communication and collaboration. Users can easily search for specific information, discuss documents in real-time, and track progress throughout a project. This enhanced level of transparency fosters better decision-making and reduces the risk of costly mistakes, all while ensuring sensitive information remains protected.

Whether you are dealing with mergers & acquisitions, legal disputes, or simply managing internal governance processes, VDRs empower you to achieve better control, efficiency, and transparency. They have become indispensable tools for modern organizations striving to stay ahead in a rapidly evolving business environment. In the following sections, we will explore the key benefits of VDRs in more detail and examine how they can revolutionize your corporate governance practices.

How Virtual Data Rooms Streamline Corporate Governance

In the modern business landscape, where data is paramount, the need for efficient and secure data management has never been more critical. Enter Virtual Data Rooms (VDRs), a revolutionary technology that is transforming the way businesses handle sensitive information, particularly within the context of corporate governance.

What is a Virtual Data Room?

Understanding the Basics: What is a VDR? How does it function?

A Virtual Data Room (VDR) is a secure online platform designed for storing, sharing, and managing sensitive documents. It acts as a central hub for critical information, providing controlled access and robust security measures. Imagine a digital vault where you can securely store confidential files and grant specific permissions to authorized users, ensuring complete control over data access.

Key attributes:

VDRs are equipped with a scope of attributes designed to streamline data management and enhance corporate governance:

- Secure Storage: VDRs employ advanced encryption technologies to safeguard sensitive data from unauthorized access, ensuring its integrity and confidentiality.

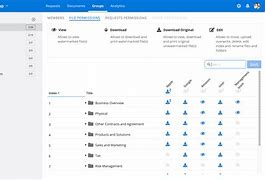

- Controlled Access: Administrators have granular control over user access, allowing them to set specific permissions for each individual, ensuring only authorized personnel can view or edit documents.

- Version Control: VDRs maintain a detailed history of all document versions, allowing users to track changes and revert to previous versions if needed, promoting accountability and transparency.

- Watermarking: VDRs can automatically watermark all documents, preventing unauthorized distribution and ensuring document integrity.

- Audit Trails: thorough audit trails track every user action within the VDR, providing a complete history of who accessed what and when, fostering accountability and transparency.

- Due Diligence Tracking: VDRs enable efficient due diligence processes, allowing users to track progress, manage querys, and offer secure communication channels.

benefits Beyond Due Diligence: VDRs are not just for mergers and acquisitions.

While VDRs are commonly associated with mergers and acquisitions (M&A) due diligence, their applications extend far beyond this realm. They can significantly enhance various facets of corporate governance, promoting efficiency, transparency, and accountability.

How Virtual Data Rooms Improve Corporate Governance

VDRs play a crucial function in bolstering corporate governance practices by addressing core principles:

Enhanced Transparency and Accountability:

VDRs promote transparency by providing real-time access to vital documents for authorized stakeholders. This allows for improved oversight and accountability, ensuring that everyone has access to the information they need to make informed decisions.

Streamlined Regulatory Compliance:

Meeting legal requirements for data management and security is paramount for any organization. VDRs help streamline compliance efforts by offering attributes that meet industry standards and regulations, such as data encryption, audit trails, and access controls.

Improved Risk Management:

Secure storage within a VDR significantly reduces the risk of data breaches and unauthorized access. By controlling who can access and modify documents, VDRs minimize the potential for data loss, theft, or misuse.

Effective Board Communication:

VDRs facilitate efficient communication and collaboration among board members by providing a secure platform for sharing sensitive information, such as financial reports, strategic plans, and confidential presentations.

VDRs and Due Diligence: A Perfect Match

Due Diligence Made Easier:

VDRs facilitate the due diligence process during M&A transactions, streamlining the exchange of critical information and ensuring data security.

Streamlined Communication:

VDRs offer secure communication channels for all parties involved in a due diligence process, enabling efficient exchange of querys, responses, and feedback.

Centralized Data Management:

VDRs act as a central repository for all due diligence documents, ensuring they are organized, readily available, and accessible to authorized parties. This centralized approach eliminates confusion and ensures everyone is working with the latest information.

Enhanced Efficiency:

VDRs expedite due diligence processes, enabling faster and more efficient information exchange, leading to quicker transaction completion.

VDRs for Various Corporate Governance facets

The benefits of VDRs extend beyond due diligence, encompassing a wide scope of corporate governance facets:

Shareholder Communication:

VDRs can securely store and share crucial documents with shareholders, such as annual reports, financial statements, and shareholder meeting materials, ensuring transparency and timely access to information.

Internal Audits and Investigations:

VDRs offer a secure platform for conducting internal audits and investigations, facilitating efficient document collection, examination, and reporting.

Legal and Regulatory Reporting:

VDRs assist in meeting legal and regulatory reporting requirements by providing a secure environment for storing and managing sensitive documents related to compliance.

Board Meetings:

VDRs enhance board meeting efficiency by providing a secure and organized platform for sharing presentations, agendas, and meeting minutes.

Choosing the Right Virtual Data Room:

Factors to Consider:

When selecting a VDR, organizations should consider various factors:

- Security: Ensure the VDR offerr offers robust security attributes, including encryption, access controls, and audit trails.

- attributes: select a platform with the attributes you need, such as document version control, watermarking, and due diligence tracking.

- Pricing: Compare pricing models from varied offerrs to find the optimal value for your specific needs.

- Scalability: select a VDR that can accommodate your current and future data storage needs.

Types of VDRs:

- Dedicated Platforms: These VDRs are designed specifically for secure document storage and sharing, offering advanced attributes and security measures.

- Cloud-Based Solutions: These platforms offer cloud-based access to VDRs, offering scalability, flexibility, and cost-efficacy.

Evaluating VDR offerrs:

- Industry Reputation: study the offerr’s track record and industry standing.

- Customer Support: Evaluate the offerr’s customer support channels and responsiveness.

- Security Certifications: Look for offerrs with pertinent security certifications and compliance accreditations.

Conclusion: Virtual Data Rooms – The Future of Corporate Governance

VDRs are not just a technological innovation; they are a fundamental shift in how businesses manage sensitive data. Embracing VDRs empowers organizations to:

Embrace Efficiency: VDRs facilitate more efficient and effective corporate governance practices by streamlining data management, improving communication, and enhancing accountability.

Data Security: VDRs offer robust security measures, safeguarding sensitive information from unauthorized access and ensuring data integrity.

Future Trends: The adoption of VDRs for improved corporate governance is expected to continue, as organizations increasingly recognize the value of secure and efficient data management.

As businesses navigate an increasingly complex regulatory landscape and strive for greater transparency and accountability, VDRs emerge as a powerful tool for achieving these objectives. By embracing the benefits of VDR technology, organizations can establish a robust foundation for sound corporate governance, fostering trust, efficiency, and long-term achievement.