- M&A Made Easy: Virtual Data Rooms for Secure Deal-Making

- What is M&A?

- What is a merger?

- What is an acquisition?

- What are the benefits of M&A?

- What are the challenges of M&A?

- Why are Virtual Data Rooms crucial for M&A?

- What is a Virtual Data Room (VDR)?

- What is a VDR?

- Why are VDRs used for M&A?

- What are the benefits of using a VDR for M&A?

- How VDRs Make M&A Easier

- Choosing the Right VDR for Your M&A Deal

- Conclusion

- Summary of the benefits of VDRs for M&A

- Call to Action: Get Started with a VDR Today!

In today’s fast-paced business environment, mergers and acquisitions (M&A) have become a strategic imperative for companies seeking growth, expansion, and market dominance. However, navigating the complexities of M&A deals can be a daunting task, demanding meticulous planning, effective communication, and robust security measures. Virtual data rooms (VDRs) have emerged as a game-changer in the M&A landscape, offering a secure and efficient platform for managing sensitive information, streamlining due diligence, and accelerating deal closure.

Imagine a secure, centralized repository where all critical deal-related documents can be accessed by authorized parties, anytime, anywhere. That’s the essence of a VDR. But VDRs are more than just digital file cabinets; they’re sophisticated platforms that automate workflows, control user access, and generate detailed audit trails, fostering transparency and accountability throughout the transaction process.

Whether you’re a seasoned M&A veteran or a first-time acquirer, VDRs provide a user-friendly interface and comprehensive functionalities that demystify the complexities of deal-making. With features like granular permissions, document version control, and automated alerts, VDRs enable efficient communication and collaboration, reducing errors and delays that can jeopardize the success of an M&A transaction.

M&A Made Easy: Virtual Data Rooms for Secure Deal-Making

Mergers and acquisitions (M&A) are complex and multifaceted processes that involve significant financial investments, legal complexities, and strategic considerations. Navigating these complexities effectively requires a robust and secure platform that enables efficient collaboration, information sharing, and due diligence. Enter Virtual Data Rooms (VDRs), a revolutionary technology that has streamlined and transformed M&A deal-making. This article will delve into the world of M&A and explore how VDRs have become indispensable tools for achieving achievementful and secure transactions.

What is M&A?

M&A refers to the consolidation of two or more companies into a single entity. It encompasses a wide scope of transactions, from mergers where two companies combine to form a new entity, to acquisitions where one company takes over another.

What is a merger?

A merger occurs when two companies agree to combine their operations and form a new, unified company. This often involves the merging of assets, liabilities, and operations into a single entity.

What is an acquisition?

An acquisition occurs when one company, the acquirer, purchases a controlling interest in another company, the target. This can take various forms, including a full takeover or a partial acquisition of a controlling stake.

What are the benefits of M&A?

M&A transactions can offer numerous benefits to both acquiring and target companies, including:

- boostd industry Share and Reach: Expanding into new industrys, diversifying product offerings, and gaining rival benefits.

- Synergies and Cost Savings: Eliminating redundancies, optimizing operations, and achieving economies of scale.

- Access to New Technologies and Resources: Acquiring valuable intellectual property, talent, and resources.

- Strategic Growth: Expanding into new segments, developing new products and services, and pursuing growth opportunities.

What are the challenges of M&A?

Despite the potential benefits, M&A transactions present a number of challenges, including:

- Due Diligence: Thoroughly vetting the target company, its financial performance, operations, and legal compliance.

- Valuation and Negotiation: Reaching a mutually agreeable price and terms for the transaction.

- Integration: effectively integrating the target company into the acquirer’s operations, including managing cultural differences and ensuring smooth transitions.

- Regulatory Compliance: Navigating complex regulatory frameworks, obtaining necessary approvals, and complying with legal requirements.

- Security and Confidentiality: Protecting sensitive information and ensuring data privacy throughout the transaction.

Why are Virtual Data Rooms crucial for M&A?

Navigating the complexities of M&A requires a robust and secure platform that enables efficient collaboration, information sharing, and due diligence. This is where VDRs come into play.

What is a Virtual Data Room (VDR)?

A Virtual Data Room (VDR) is a secure online platform used to store, manage, and share sensitive information during M&A transactions, due diligence processes, and other business-critical activities.

What is a VDR?

VDRs are essentially secure, cloud-based repositories that offer a central hub for storing and managing all the documentation related to a transaction.

Why are VDRs used for M&A?

VDRs have become indispensable tools for M&A transactions due to their ability to address the challenges of information management, security, and collaboration.

What are the benefits of using a VDR for M&A?

- Streamlined Due Diligence: VDRs facilitate efficient due diligence by providing a centralized repository for all pertinent documents, enabling faster and more thorough review processes.

- Enhanced Security and Confidentiality: VDRs implement robust security measures, such as encryption, access controls, and audit trails, ensuring the protection of sensitive information.

- Improved Transparency and Accountability: VDRs offer real-time access to information, audit trails, and reporting capabilities, enhancing transparency and accountability throughout the transaction.

- boostd Efficiency and Collaboration: VDRs enable seamless collaboration between parties involved in the transaction, facilitating communication, file sharing, and efficient workflow management.

How VDRs Make M&A Easier

Streamlined Due Diligence:

- Faster and more efficient due diligence process: VDRs offer a centralized repository for all pertinent documents, allowing parties to access and review information quickly and efficiently.

- Reduced risk of errors and omissions: VDRs enable thorough document organization and search functionality, reducing the risk of missing critical information or overlooking crucial details.

- Improved communication and collaboration: VDRs facilitate communication and collaboration between all parties involved, including legal counsel, financial advisors, and technical experts, ensuring everyone is on the same page.

Enhanced Security and Confidentiality:

- Watertight security measures: VDRs employ advanced security protocols, including encryption, multi-factor authentication, and access controls, to protect sensitive information.

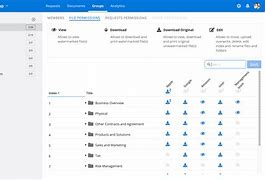

- Controlled access and permissions: VDRs allow administrators to control access to specific documents or sections of the platform, ensuring only authorized individuals can view certain information.

- Audit trails and reporting: VDRs maintain detailed logs of all user activity, providing audit trails and reports that can be used to demonstrate compliance and track information access.

Improved Transparency and Accountability:

- Real-time access to information: VDRs offer real-time access to information, enabling all parties to stay informed about the latest updates and developments.

- Auditable data trails: VDRs offer thorough audit trails, documenting every action taken within the platform, ensuring transparency and accountability.

- boostd efficiency and accountability: VDRs streamline workflows, improve communication, and offer clear documentation, enhancing overall efficiency and accountability.

Choosing the Right VDR for Your M&A Deal

selecting the right VDR is crucial for ensuring a smooth and achievementful M&A transaction. Consider these factors:

Key attributes to Consider:

- Security and Compliance: The VDR platform should meet industry standards for data security and compliance with pertinent regulations.

- Ease of Use: The platform should be user-friendly and intuitive, allowing for easy navigation and document management.

- Integration with Other Systems: The VDR should seamlessly integrate with other systems used by the parties involved, such as email, document management, and communication platforms.

- Pricing and Support: Consider the pricing structure, support options, and overall value proposition of the VDR offerr.

Tips for Choosing the optimal VDR:

- study and Compare varied offerrs: Explore various VDR offerrs, compare their attributes, pricing, and reputation.

- Get a Demo and Test Drive the Platform: Request a demo to experience the platform firsthand and assess its user-friendliness and functionality.

- Read Reviews and Case Studies: Seek feedback from other users and explore case studies to understand the experiences of previous clients.

- Consider Your Specific Needs and Budget: Determine your specific requirements and budget constraints to select the VDR that optimal meets your needs.

Conclusion

Virtual Data Rooms have revolutionized the way M&A transactions are conducted, providing a secure and efficient platform for due diligence, information sharing, and collaboration. VDRs enhance security, streamline workflows, improve transparency, and ultimately make M&A processes smoother and more achievementful. By carefully selecting the right VDR and leveraging its attributes, companies can navigate the complexities of M&A with greater confidence and achieve their strategic objectives.

Summary of the benefits of VDRs for M&A

- Streamlined Due Diligence: Faster, more efficient, and reduced risk of errors.

- Enhanced Security and Confidentiality: Watertight security, controlled access, and audit trails.

- Improved Transparency and Accountability: Real-time access to information, auditable data trails, and boostd efficiency.

Call to Action: Get Started with a VDR Today!

If you are considering an M&A transaction, explore the benefits of VDRs and select a platform that meets your specific needs. VDRs can significantly enhance your deal-making process, ensuring a smoother, more secure, and more achievementful outcome.