You’ve been injured, maybe in an accident, and now you’re dealing with the fallout: medical bills, lost wages, and the uncertainty of your future. It’s a tough situation, and the last thing you need is more confusion. Enter structured settlements, a unique financial arrangement that offers a lifeline for those dealing with substantial financial hardship. But are structured settlements right for you?

In a nutshell, structured settlements are a way to receive your injury compensation in regular payments over an extended period, usually years. Instead of receiving a lump sum, you opt for a stream of payments, potentially including a combination of tax-free payments, future medical payments, and monthly annuities. This seems like a pretty sweet deal, right? It’s like getting your settlement money with a financial advisor attached, managing the funds for you.

But, like any financial decision, structured settlements have their advantages and disadvantages. It’s important to thoroughly understand these factors before committing, as making the right choice could profoundly impact your long-term financial stability.

So, how do structured settlements work? Are they truly the right choice for you? Let’s dive into the nitty-gritty details and answer these burning questions, exploring the potential benefits, risks, and alternative options. You deserve to make informed financial decisions, especially during such a challenging time. This guide aims to equip you with the information you need to navigate the complex world of structured settlements and ultimately determine the best course of action for your individual circumstances. Let’s break down the benefits and drawbacks and help you make the right choice.

Structured Settlements Explained: Are They the Right Choice for You?

When facing a personal injury, navigating the aftermath can be overwhelming. One crucial decision involves how to receive your settlement: a lump sum or a structured settlement. While lump sums offer immediate cash, structured settlements offer a steady stream of income over time. This article will guide you through the intricacies of structured settlements, helping you determine if they’re the right choice for your situation.

What are Structured Settlements?

Structured settlements are a form of settlement in which the payment is received in regular installments over a set period, rather than all at once. They are often used in personal injury cases and are designed to offer long-term financial security.

meaning of Structured Settlements

A structured settlement is a legally binding agreement between a plaintiff (the injured party) and a defendant (the party at fault) that involves receiving compensation in installments over a period of time.

How they Work: Lump-Sum vs. Periodic Payments

Imagine receiving a large sum of money after a personal injury. While tempting, this lump sum could be easily mismanaged, leading to financial instability. A structured settlement offers a more secure approach by distributing the funds in regular payments, ensuring a steady income stream.

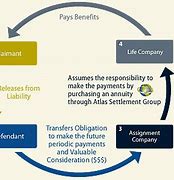

The function of an Annuity Company

Annuity companies play a pivotal function in structured settlements. They issue annuities, contracts that guarantee regular payments for a specified duration. The annuity company receives the settlement funds and is responsible for making the periodic payments to the recipient.

Key attributes of Structured Settlements

Structured settlements typically include these key attributes:

- Regular Payments: Payments are made on a consistent schedule, such as monthly, quarterly, or annually.

- Guaranteed Income: Payments are guaranteed for the specified duration, offering financial stability.

- Tax benefits: Structured settlements often offer tax benefits, potentially reducing the overall tax burden.

- Flexibility: Payment schedules can be customized to fit individual needs, including adjustments for future education or healthcare expenses.

Examples of Structured Settlements in Action

- A young child injured in a car accident: A structured settlement could offer regular payments for their medical expenses, lost wages (once they reach working age), and college tuition.

- A middle-aged individual with a permanent disability: Payments could cover ongoing medical care, living expenses, and lost wages for a lifetime.

- A family that lost a loved one in a wrongful death: Structured settlements can ensure long-term financial security for surviving dependents.

benefits of Structured Settlements

Structured settlements offer several significant benefits:

Financial Security:

- Guaranteed Income Stream for the Future: This offers consistent income for the long term, ensuring financial stability even in uncertain times.

- Protection from Financial Mismanagement: Unlike a lump sum, a structured settlement eliminates the risk of squandering the funds, safeguarding financial well-being.

- Stability in Uncertain Times: Structured settlements offer a safety net in the face of industry fluctuations, ensuring a steady income regardless of economic conditions.

Tax benefits:

- Potential Tax benefits on Structured Payments: The tax implications of structured settlements can be favorable compared to lump-sum payments.

- Understanding the Tax Implications: Consult with a tax advisor to understand the specific tax benefits and potential liabilities associated with your structured settlement.

- Consulting with a Tax Advisor: A tax professional can offer expert advice on maximizing tax benefits and navigating tax regulations.

Flexibility:

- Customization of Payment Schedules: Structured settlements can be tailored to your specific financial needs, including the frequency and duration of payments.

- Adjustments for Specific Needs: Payments can be adjusted to accommodate changing circumstances, such as rising medical expenses or educational costs.

- Options for Future Needs: Structured settlements can be designed to offer funds for future expenses, such as education, healthcare, or retirement.

Protection for Beneficiaries:

- Guaranteeing Financial Support for Dependents: Structured settlements can offer ongoing financial support for surviving family members after a wrongful death.

- Secure Long-Term Financial Stability for Families: They can ensure financial stability for families, particularly for dependents who may be vulnerable.

- Planning for Future Generations: Structured settlements can be used to secure the financial future of children and grandchildren, ensuring their well-being for years to come.

Drawbacks of Structured Settlements

While structured settlements offer significant benefits, it’s crucial to acknowledge potential drawbacks:

Limited Liquidity:

- Lack of Immediate Access to Large Sums of Money: Structured settlements offer a steady income stream, but you won’t have access to a large lump sum of money immediately.

- Potential Financial Constraints in the Short Term: This could pose financial challenges if you need a significant sum of money upfront.

Interest Rates and Inflation:

- Impact of Inflation on Payment Value: The value of your payments could be eroded by inflation over time, reducing their purchasing power.

- Fluctuations in Interest Rates: Changes in interest rates can affect the overall value of the structured settlement.

Flexibility Limitations:

- Changing Circumstances: Life is unpredictable, and your financial needs may change. Modifying a structured settlement can be challenging and may involve legal fees.

- Potential for Difficulties in Adjusting Payments: Making adjustments to the payment schedule could involve negotiations and legal complexities.

Potential for Legal Disputes:

- Disputes Over Ownership or Control of Settlements: Legal disputes may arise over the ownership or control of the structured settlement, particularly if there are multiple beneficiaries.

- Legal Fees Associated with Modifying Structured Settlements: Modifying a structured settlement can be expensive, involving legal fees and court costs.

Structured Settlements vs. Lump-Sum Payments

Direct Comparison:

| attribute | Structured Settlement | Lump-Sum Payment |

|—|—|—|

| Access to Funds | Regular payments over time | Immediate access to a large sum of money |

| Financial Control | Less immediate control over funds | Complete control over the funds |

| Financial Stability | Guaranteed income stream for the long term | Potential for financial mismanagement |

| Investment Opportunities | Limited investment opportunities | Greater potential for investment growth |

| Assured Income | Yes | No |

Factors to Consider When Deciding:

- Personal Financial Situation: Assess your current financial situation, including your debt levels, income, and savings.

- Risk Tolerance: Consider your comfort level with financial risk. A structured settlement offers less risk, while a lump sum offers more flexibility but also greater risk.

- Future Financial Needs: Think about your future financial objectives, such as education, healthcare, or retirement. A structured settlement can help secure these objectives.

Who benefits from Structured Settlements?

Structured settlements can be beneficial for various individuals and families:

Personal Injury Victims:

- Long-Term Medical Expenses: Structured settlements can offer a continuous stream of income to cover ongoing medical costs, ensuring that you receive the care you need.

- Lost Wages and Income: They can help replace lost wages and income, providing financial stability during your recovery period.

- Protecting Families from Financial Hardship: Structured settlements can help safeguard your family’s financial well-being in the event of a severe injury or disability.

Families of Deceased Victims:

- Financial Security for Dependents: Structured settlements can offer financial security for surviving spouses and children, ensuring their long-term well-being.

- Long-Term Financial Planning: They can assist with long-term financial planning, ensuring that your family has the resources they need for the future.

- Ensuring Financial Stability for Future Generations: Structured settlements can be used to create a legacy for future generations, providing financial stability for your children and grandchildren.

Individuals with Special Needs:

- Lifetime Care and Support: Structured settlements can offer ongoing income to cover the costs of specialized care and support for individuals with disabilities.

- Financial Independence: They can help individuals with special needs achieve financial independence, enabling them to live more fulfilling lives.

- Guaranteed Income for Long-Term Needs: Structured settlements ensure a guaranteed income stream for long-term needs, such as housing, medical care, and daily living expenses.

How to Get a Structured Settlement

Negotiating a Settlement:

- Working with Legal Professionals: An experienced personal injury attorney can help you negotiate a fair and favorable settlement, including the option of a structured settlement.

- Understanding the Terms of the Settlement: Carefully review the terms of the structured settlement agreement to ensure it meets your needs and protects your interests.

- Choosing the Right Structured Settlement Option: Work with your attorney and an annuity company to select the most appropriate structured settlement option for your circumstances.

Working with an Annuity Company:

- Choosing a Reputable Company: select a reputable annuity company with a strong track record of financial stability and customer service.

- Understanding the Annuity Agreement: Read and understand the terms of the annuity agreement, including the payment schedule, tax implications, and any potential fees.

- Securing Financial Stability for the Future: Annuity companies offer financial stability by guaranteeing the regular payments of the structured settlement, ensuring your financial security for the long term.

Final Thoughts: Are Structured Settlements Right for You?

Weighing the pros and cons of structured settlements and considering your individual circumstances is crucial. Don’t hesitate to consult with financial advisors and tax professionals for guidance and expert advice.

Weighing the Pros and Cons:

Carefully assess the benefits and drawbacks of structured settlements, taking into account your financial needs, risk tolerance, and long-term objectives.

Considering Your Specific Needs and Circumstances:

Evaluate your unique situation, including your age, health, dependents, and future financial objectives.

Consulting with Financial Advisors:

Seek advice from qualified financial advisors who can offer personalized recommendations and help you make informed decisions.

Making an Informed Decision About Your Financial Future:

By carefully considering the information offerd in this article, engaging with professionals, and understanding your specific circumstances, you can make an informed decision about whether a structured settlement is the right choice for your financial future.

Conclusion

Structured settlements can be a valuable tool for financial security, offering consistent income, tax benefits, and flexibility. However, they are not a one-size-fits-all solution. By understanding the benefits, drawbacks, and nuances of structured settlements, you can make an informed decision about whether they align with your personal situation and financial objectives.