In today’s business landscape, where data is the new gold, transparency and accountability are more crucial than ever. Corporate transparency, specifically, plays a vital role in building trust with stakeholders, including investors, customers, and employees. A vital tool in achieving this level of transparency is the Virtual Data Room (VDR). VDRs have emerged as game-changers, offering a secure and efficient way to manage sensitive information and foster trust among stakeholders. This article will explore the profound impact of VDRs on corporate transparency and how they can revolutionize the way businesses operate in today’s dynamic and competitive world.

VDRs essentially serve as centralized, secure platforms for storing, organizing, and sharing sensitive information. They allow organizations to manage critical documents, contracts, financial records, and other vital data in a secure and controlled environment. These platforms are equipped with advanced security measures, ensuring that access is strictly controlled and data remains confidential. This is crucial for organizations seeking to maintain the integrity of their operations and safeguard sensitive information from unauthorized access or data breaches.

One of the primary ways VDRs impact corporate transparency is by facilitating due diligence processes. During mergers & acquisitions (M&A) transactions, investors and potential acquirers often require access to extensive documentation to assess the financial health, operations, and future prospects of the target company. VDRs enable a seamless and transparent due diligence process, providing stakeholders with real-time access to vital documents and information, streamlining the review process, and minimizing delays.

VDRs also play a significant role in investor relations and corporate governance. They provide a secure platform for sharing financial reports, presentations, and other relevant documents with investors, allowing for greater transparency and communication. With VDRs, investors have access to essential information anytime, anywhere, promoting accountability and fostering trust in the organization’s governance practices.

The Impact of Virtual Data Rooms on Corporate Transparency

In today’s business landscape, transparency is paramount. Companies are under increasing pressure to be open and accountable to stakeholders, including investors, customers, and regulators. Virtual data rooms (VDRs) are emerging as a powerful tool for achieving this objective, revolutionizing how companies manage sensitive information and fostering a more transparent business environment.

What is a Virtual Data Room?

A virtual data room (VDR) is a secure online platform where sensitive documents and information can be shared and managed. It’s often used in due diligence processes for mergers and acquisitions (M&A), fundraising, and other corporate transactions.

attributes:

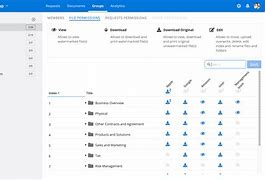

- Secure Access Control: VDRs offer robust security attributes like multi-factor authentication, encryption, and access logs. This ensures only authorized individuals can access sensitive information, minimizing the risk of data leaks.

- Document Management: VDRs allow you to organize, categorize, and manage a large volume of documents efficiently. You can easily search, filter, and retrieve specific documents, saving valuable time and effort.

- Version Control: VDRs keep track of document updates and ensure everyone is working with the most recent versions. This eliminates confusion and reduces the risk of errors.

- Collaboration Tools: VDRs enable communication and collaboration between parties involved in a transaction. Users can share comments, annotations, and querys directly on documents, fostering seamless collaboration and faster decision-making.

How do Virtual Data Rooms Improve Transparency?

VDRs contribute to corporate transparency in several ways:

- Reduced Risk of Data Leaks: The secure environment of a VDR minimizes the risk of sensitive information being leaked or accessed by unauthorized individuals. This is critical for protecting confidential data during due diligence, fundraising, or litigation.

- Improved Data Integrity: Version control and document management attributes ensure the accuracy and completeness of information. This eliminates the risk of outdated or inaccurate information being used, promoting transparency and accountability.

- Enhanced Audit Trail: Access logs offer a clear record of who accessed what information and when. This enables traceability and accountability, demonstrating a commitment to transparency and ensuring that all actions are properly documented.

The Impact of Virtual Data Rooms on Corporate Transparency

Due Diligence and Corporate Transparency:

- Streamlined Due Diligence: VDRs make the due diligence process more efficient and effective. Participants can access documents easily, anytime, anywhere, allowing for faster and more thorough reviews.

- Improved Data Accessibility: VDRs offer a centralized repository for all pertinent documents, making them readily accessible to all parties involved in a transaction. This fosters a more transparent due diligence process, ensuring that all parties have access to the same information.

- Reduced Costs and Time: Automated processes and online document storage minimize the need for physical document handling and travel. This leads to cost savings and faster transaction completion, making due diligence more efficient and cost-effective.

Beyond Due Diligence:

- boostd Transparency in Fundraising: VDRs enable investors to access thorough information about a company’s financial performance and operations. This transparency fosters greater trust and confidence among investors, leading to more achievementful fundraising rounds.

- Transparency in Litigation and Regulatory Investigations: VDRs can be used to securely share documents during litigation and regulatory investigations. This promotes transparency and accountability, enabling investigators to access pertinent information quickly and efficiently.

- Improving Corporate Governance: VDRs can support internal audits, regulatory compliance, and other corporate governance initiatives. By providing secure and accessible access to pertinent documents, VDRs enhance transparency and accountability within the organization.

Choosing the Right Virtual Data Room

Key Considerations:

- Security attributes: Ensure the VDR offerr offers robust security attributes to protect sensitive information. Look for attributes like multi-factor authentication, encryption, access logs, and regular security audits.

- User-friendliness: select a platform with an intuitive interface and easy-to-use attributes. This will ensure that users can easily navigate the platform and access the information they need.

- Scalability: select a VDR that can accommodate the size and complexity of your organization’s data. The platform should be able to handle large volumes of documents and users without compromising performance.

- Cost: Compare pricing plans and attributes to find a VDR that fits your budget. Consider factors like the number of users, storage space, and attributes included in the price.

benefits of Using a VDR:

- boostd Efficiency: VDRs streamline processes and reduce manual tasks, saving time and resources. Automated attributes like document indexing and search capabilities enhance productivity.

- Enhanced Collaboration: VDRs facilitate seamless collaboration between internal and external stakeholders. Real-time collaboration tools allow for efficient communication and decision-making, improving project outcomes.

- Improved Transparency: VDRs promote transparency by providing easy access to information and creating an audit trail. This builds trust and confidence with stakeholders, fostering stronger relationships.

- Enhanced Security: VDRs protect sensitive information from unauthorized access and data breaches. Robust security measures ensure the confidentiality and integrity of your data, safeguarding your organization from risks.

Conclusion: The Future of Transparency

VDRs are playing a pivotal function in shaping the future of corporate transparency. As businesses increasingly rely on digital platforms for communication and collaboration, VDRs are becoming essential tools for facilitating secure and transparent transactions.

By embracing VDRs, companies can enhance their due diligence processes, improve access to information, and build trust with stakeholders. The use of VDRs is likely to continue expanding as businesses seek to streamline operations and ensure transparency in an increasingly digital world.