In the fast-paced world of business today, efficiency, security, and collaboration are paramount. Enter the virtual data room (VDR), a game-changer in how businesses manage sensitive information, particularly during mergers, acquisitions, and due diligence processes. VDRs offer a centralized platform for storing, sharing, and controlling access to crucial documents. As we delve into 2024, understanding the evolving trends in VDR technology is critical for any company seeking to stay ahead of the curve. This article will explore key trends shaping the VDR landscape this year and how businesses can leverage these developments for enhanced efficiency and competitive advantage.

With the increasing complexity of business operations, the demand for robust security features is escalating. VDRs have traditionally been a safe haven for sensitive data. However, with the constant emergence of new cyber threats, companies are seeking even more stringent security protocols. Expect to see an uptick in advanced security measures within VDRs in 2024. These will likely include features such as end-to-end encryption, granular user access control, multi-factor authentication, and comprehensive audit trails, offering unparalleled protection against unauthorized access and data breaches.

Furthermore, the integration of artificial intelligence (AI) is poised to revolutionize VDRs this year. AI-powered tools within VDR platforms can significantly streamline workflows, enhance data analysis, and facilitate collaboration. Imagine VDRs that can automatically index documents, identify critical information, and suggest relevant insights based on historical data. These features not only save time but also provide valuable insights that can inform strategic decisions.

Virtual Data Room Trends Every Business Should Know in 2024

The business landscape is constantly evolving, and with it, the need for efficient and secure ways to manage sensitive information. In this digital age, virtual data rooms (VDRs) have emerged as a crucial tool for businesses across industries. These platforms offer a secure and centralized location to store, share, and manage critical documents, facilitating seamless collaboration and streamlined processes. As we enter 2024, the VDR industry is experiencing significant growth, driven by advancements in technology and evolving business needs.

What is a Virtual Data Room (VDR)?

A virtual data room (VDR) is a secure online platform that allows businesses to store, manage, and share sensitive documents with authorized parties. VDRs are typically used for complex transactions involving due diligence, such as mergers and acquisitions (M&A), fundraising, real estate deals, and legal proceedings.

How does a Virtual Data Room work?

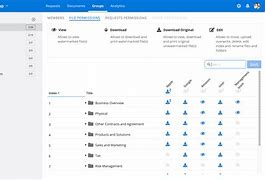

VDRs function by creating a secure and controlled environment for document sharing. Users can upload and organize their documents, set access permissions, and track activity within the platform. VDRs typically offer advanced attributes like:

- Document version control: Ensuring everyone is working with the latest information.

- Watermarking and audit trails: Maintaining accountability and tracking document access.

- Secure communication: Enabling encrypted communication for sensitive discussions.

- Access control: Allowing administrators to restrict access to specific documents or folders.

Who uses Virtual Data Rooms?

VDRs are used by a wide scope of businesses and organizations, including:

- Financial institutions: For M&A due diligence, loan syndication, and private equity deals.

- Law firms: For managing legal documents, conducting discovery, and protecting client confidentiality.

- Real estate companies: For sharing property information, managing due diligence processes, and facilitating negotiations.

- Healthcare offerrs: For managing patient data, conducting clinical trials, and complying with HIPAA regulations.

- Technology companies: For intellectual property management, licensing agreements, and product development.

Virtual Data Room Trends in 2024

As the demand for secure and efficient data management solutions grows, the VDR industry is undergoing significant transformations. Here are some key trends to watch out for in 2024:

boostd Adoption of Virtual Data Rooms:

VDR adoption is surging across industries as businesses recognize their numerous benefits.

Reasons for the boost in VDR adoption:

- Enhanced security: VDRs offer a higher level of security than traditional data rooms, protecting sensitive information from unauthorized access.

- Improved collaboration: VDRs facilitate streamlined communication and collaboration among stakeholders, regardless of their location.

- Reduced costs: VDRs can help businesses save on administrative costs and improve efficiency.

- boostd transparency: VDRs offer a centralized platform for document management, ensuring transparency and accountability.

Examples of industries using VDRs:

- Mergers and Acquisitions (M&A): VDRs are becoming indispensable for M&A transactions, enabling efficient due diligence and streamlining the entire process.

- Fundraising: VDRs are used by companies to share confidential information with potential investors, ensuring a secure and transparent process.

- Real Estate: VDRs are increasingly used in real estate transactions, simplifying due diligence, negotiations, and closing.

- Legal and Regulatory Compliance: VDRs offer a robust platform for managing sensitive data and ensuring compliance with various regulations.

Enhanced Security attributes:

Data security is paramount in the digital age, and VDR offerrs are constantly enhancing their security attributes to meet evolving threats.

Importance of data security in VDRs:

- Data breaches: VDRs are crucial for safeguarding sensitive information, as traditional data rooms can be vulnerable to breaches.

- Compliance regulations: VDRs must comply with industry-specific regulations, such as GDPR, HIPAA, and SOX, to protect sensitive data.

- Reputation management: Data breaches can damage a company’s reputation, leading to financial losses and customer distrust.

Latest security attributes offered by VDR offerrs:

- Multi-factor authentication: Adding an extra layer of security by requiring multiple forms of verification.

- Encryption: Encrypting data both at rest and in transit to prevent unauthorized access.

- Access control: Allowing administrators to set granular access permissions based on user functions.

- Audit trails: Recording all user activity within the VDR to track access, edits, and downloads.

Examples of data security breaches in traditional data rooms:

- Physical theft: Traditional data rooms containing hard copies of documents are vulnerable to theft.

- Unauthorized access: Lack of access control in traditional data rooms can lead to unauthorized access and data breaches.

- Data leaks: Unsecure storage methods in traditional data rooms can outcome in data leaks.

Integration with Other Business Tools:

VDRs are becoming increasingly integrated with other business tools to enhance efficiency and collaboration.

benefits of integrating VDRs with other tools:

- Streamlined workflows: Seamless integration eliminates the need for manual data transfer and improves efficiency.

- Centralized access: Integrating VDRs with other tools offers a single point of access for all pertinent information.

- Enhanced collaboration: Integration enables seamless collaboration across teams and departments, fostering better communication and alignment.

Examples of integrations with popular software:

- CRM systems: Integrating with CRM systems enables the storage and access of client information within the VDR.

- Project management tools: Integration with project management tools facilitates document sharing and task management within the VDR.

- E-signature platforms: Integration with e-signature platforms simplifies the approval process for documents stored in the VDR.

How integration improves efficiency and collaboration:

- Automated workflows: Integration enables automated workflows for tasks like document approval and data sharing, reducing manual effort.

- Data synchronization: Integration ensures that data is synchronized across varied tools, preventing data silos and inconsistencies.

- Real-time updates: Integration allows users to access real-time updates on documents and projects within the VDR.

Artificial Intelligence (AI) and Machine Learning (ML) in VDRs:

AI and ML are revolutionizing VDR functionality, offering advanced attributes and automating tasks.

How AI and ML are enhancing VDR functionality:

- Automated document indexing: AI algorithms can analyze documents and automatically create indexes for efficient searching.

- Smart document search: ML-powered search capabilities allow users to find pertinent documents using natural language queries.

- Data extraction and examination: AI can extract data from documents and generate insights, streamlining due diligence processes.

- Anomaly detection: AI can detect unusual patterns in user activity and alert administrators to potential security threats.

Examples of AI/ML attributes in VDRs:

- Automatic document classification: AI algorithms can automatically categorize documents based on their text, improving organization and search efficiency.

- Smart redaction: AI can help users quickly and accurately redact sensitive information from documents.

- Intelligent insights: ML algorithms can analyze data and generate insights about document text, providing valuable information for decision-making.

Impact of AI/ML on due diligence processes:

- Faster turnaround times: AI-powered attributes can significantly reduce the time required for due diligence, allowing for quicker decision-making.

- Improved accuracy: AI algorithms can determine potential risks and inconsistencies in data, improving the accuracy of due diligence reports.

- Enhanced insights: AI can analyze large datasets and offer valuable insights that may not be apparent through manual review.

Cloud-Based VDRs:

Cloud-based VDRs are becoming increasingly popular, offering scalability, flexibility, and cost-efficacy.

benefits of cloud-based VDRs:

- Scalability: Cloud-based VDRs can easily scale to accommodate the needs of growing businesses, without the need for expensive hardware upgrades.

- Flexibility: Users can access VDRs from anywhere with an internet connection, providing flexibility and remote collaboration capabilities.

- Cost-efficacy: Cloud-based VDRs eliminate the need for expensive on-premise hardware and software licenses, offering a more cost-effective solution.

Scalability and flexibility of cloud-based solutions:

- Dynamic resource allocation: Cloud-based VDRs can dynamically allocate resources based on demand, ensuring optimal performance for users.

- Accessibility: Cloud-based VDRs are accessible from any device with an internet connection, improving collaboration and remote work capabilities.

- Data backup and recovery: Cloud-based VDRs typically offer robust data backup and recovery attributes, protecting data from loss or damage.

Comparison to on-premises VDRs:

- Cost: On-premises VDRs are more expensive due to the initial investment in hardware and software, as well as ongoing maintenance costs.

- Security: Cloud-based VDRs offer a higher level of security due to dedicated security teams and advanced security attributes.

- Scalability: On-premises VDRs can be difficult to scale, requiring significant infrastructure investments to accommodate growth.

Virtual Data Room Use Cases

VDRs have become essential tools for various business processes, offering secure and efficient solutions for managing sensitive information. Here are some key use cases:

Mergers and Acquisitions (M&A) Due Diligence:

VDRs are essential for M&A transactions, streamlining the due diligence process and facilitating smooth transactions.

How VDRs streamline the M&A due diligence process:

- Secure document sharing: VDRs offer a secure platform for sharing confidential information with potential buyers or sellers.

- Centralized access: VDRs offer a centralized location for all due diligence documents, simplifying access and organization.

- Efficient communication: VDRs facilitate communication among stakeholders, enabling seamless collaboration and timely decision-making.

- Audit trails: VDRs maintain audit trails of all user activity, ensuring transparency and accountability.

benefits of using a VDR for M&A transactions:

- Reduced turnaround time: VDRs accelerate the due diligence process, allowing for faster transactions.

- Improved accuracy: VDRs enhance the accuracy of due diligence reports by providing organized and readily accessible information.

- Enhanced collaboration: VDRs facilitate seamless communication and collaboration among stakeholders, improving efficiency.

- Reduced costs: VDRs can help reduce the cost of M&A transactions by automating tasks and streamlining workflows.

Examples of achievementful VDR implementations in M&A:

- Private equity firms: VDRs are used by private equity firms to manage due diligence processes for acquisitions and investments.

- Strategic acquisitions: VDRs facilitate the exchange of confidential information during strategic acquisitions, ensuring a smooth and secure process.

- Cross-border M&A: VDRs enable secure and efficient collaboration across varied jurisdictions, facilitating cross-border M&A transactions.

Fundraising and Investor Relations:

VDRs are valuable for fundraising and investor relations, enabling secure document sharing and investor communication.

Utilizing VDRs for investor presentations and due diligence:

- Secure document sharing: VDRs offer a secure platform for sharing confidential information with potential investors, such as financial statements, business plans, and due diligence materials.

- Access control: VDRs allow administrators to set access permissions for varied investors, ensuring that sensitive information is shared only with authorized parties.

- Investor communication: VDRs facilitate communication between companies and investors, enabling efficient Q&A sessions and document sharing.

benefits of using VDRs in fundraising rounds:

- Improved investor relations: VDRs facilitate efficient and transparent communication with investors, improving investor relations and trust.

- Accelerated fundraising: VDRs streamline the due diligence process, allowing for faster fundraising rounds.

- Reduced costs: VDRs can reduce the costs associated with fundraising by automating tasks and streamlining workflows.

- Enhanced transparency: VDRs offer a central platform for all fundraising documents, ensuring transparency and accountability.

Examples of how VDRs facilitate investor communication:

- Investor updates: Companies can use VDRs to share regular updates with investors, keeping them informed about progress and milestones.

- Q&A sessions: VDRs enable secure and efficient Q&A sessions with investors, addressing concerns and providing clarification.

- Investor due diligence: VDRs offer a secure platform for investors to conduct due diligence, accessing all pertinent information.

Real Estate Transactions:

VDRs are increasingly used in real estate transactions, simplifying due diligence and facilitating negotiations.

How VDRs simplify real estate transactions:

- Due diligence management: VDRs streamline the due diligence process, enabling efficient sharing and review of property documents.

- Negotiation and closing: VDRs facilitate communication and collaboration among stakeholders, streamlining negotiations and closing processes.

- Document storage and access: VDRs offer a secure and centralized location for all real estate documents, ensuring easy access and organization.

benefits of using a VDR for due diligence and negotiations:

- Improved efficiency: VDRs automate tasks and streamline workflows, reducing the time and effort required for real estate transactions.

- Enhanced transparency: VDRs offer a central platform for all transaction documents, ensuring transparency and accountability.

- Reduced costs: VDRs can help reduce the cost of real estate transactions by streamlining processes and reducing the need for physical documents.

Examples of real estate transactions using VDRs:

- Commercial real estate: VDRs are used for managing due diligence processes for commercial real estate acquisitions and sales.

- Residential real estate: VDRs can simplify the process of buying and selling residential properties, streamlining communication and document sharing.

- Property development: VDRs are used to manage complex property development projects, facilitating collaboration among stakeholders and ensuring secure document management.

Legal and Regulatory Compliance:

VDRs are crucial for managing sensitive data and ensuring compliance with legal and regulatory requirements.

VDRs for managing sensitive data and legal documents:

- Data privacy: VDRs offer robust security attributes to protect sensitive data, complying with regulations such as GDPR, HIPAA, and SOX.

- Legal discovery: VDRs facilitate efficient and secure sharing of legal documents during discovery processes, ensuring compliance with legal requirements.

- Contract management: VDRs offer a secure platform for managing contracts, ensuring compliance with regulatory requirements and protecting confidential information.

Compliance with data privacy regulations (GDPR, HIPAA, etc.):

- Data encryption: VDRs employ strong encryption methods to protect data both at rest and in transit, complying with data privacy regulations.

- Access control: VDRs allow administrators to set granular access permissions based on user functions and data sensitivity, ensuring compliance with data privacy regulations.

- Audit trails: VDRs maintain detailed audit trails of all user activity, providing a record of data access and modifications for compliance purposes.

Examples of how VDRs ensure compliance in sensitive industries:

- Healthcare: VDRs are used by healthcare offerrs to manage patient data, ensuring compliance with HIPAA regulations.

- Financial services: VDRs are used by financial institutions to manage sensitive client data, ensuring compliance with regulations such as GDPR and SOX.

- Legal: VDRs are used by law firms to manage confidential client information and ensure compliance with attorney-client privilege and other legal requirements.

Other Use Cases:

VDRs are versatile tools with applications beyond the aforementioned use cases, including:

- Intellectual property management: VDRs can be used to securely store and share intellectual property documents, such as patents, trademarks, and copyrights.

- Contract management and negotiations: VDRs offer a secure platform for managing contracts, facilitating negotiations and ensuring compliance with legal requirements.

- Corporate governance and compliance: VDRs can be used to manage corporate governance documents, ensuring compliance with regulatory requirements and promoting transparency.

Choosing the Right Virtual Data Room offerr

selecting the right VDR offerr is crucial for businesses to ensure secure, efficient, and compliant data management.

Key factors to consider when choosing a VDR offerr:

- Security attributes and compliance certifications: Ensure the offerr offers robust security attributes and complies with pertinent industry regulations (GDPR, HIPAA, etc.).

- attributes and functionality offered: Consider the attributes and functionality that align with your specific needs, such as document version control, audit trails, and integrations with other business tools.

- Pricing and paid access models: Evaluate varied pricing plans and paid access models to find a solution that fits your budget.

- User experience and support: select a offerr with a user-friendly interface and responsive customer support.

Tips for evaluating VDR offerrs:

- Requesting demos and comparing attributes: Request demos from several offerrs to compare attributes, functionality, and user interface.

- Reading customer reviews and testimonials: Read reviews and testimonials from other users to gain insights into the offerr’s reputation and performance.

- Consulting with industry experts: Consult with industry experts or legal professionals for recommendations and guidance on selecting the right VDR offerr.

Conclusion

The virtual data room industry is experiencing rapid growth, driven by advancements in technology and evolving business needs. VDRs are becoming increasingly essential for businesses of all sizes, offering secure and efficient solutions for managing sensitive information and streamlining complex processes.

In 2024, we can expect to see continued advancements in VDR technology, including enhanced security attributes, seamless integration with other business tools, and boostd adoption of AI and ML capabilities. Cloud-based VDRs are becoming increasingly popular, offering scalability, flexibility, and cost-efficacy.

By adopting VDRs and leveraging their advanced attributes, businesses can enhance data security, improve collaboration, streamline processes, and gain a rival benefit in today’s dynamic business environment. To make the most of VDRs, businesses should carefully evaluate their needs and select a offerr that offers the right attributes, functionality, and security measures.