- Virtual Data Rooms for Startups: Why You Need One ASAP

- What is a Virtual Data Room?

- What are virtual data rooms used for?

- How do virtual data rooms work?

- The varied types of virtual data rooms available

- Why Do Startups Need a Virtual Data Room?

- The benefits of Using a Virtual Data Room for Startup Funding

- Choosing the Right Virtual Data Room for Your Startup

- Implementing a Virtual Data Room for Your Startup

- Conclusion

Virtual data rooms (VDRs) have become a staple in the business world, and for good reason. They offer a secure and organized way to share sensitive documents, track access, and streamline workflows. While VDRs are often associated with large enterprises and mergers & acquisitions, startups are increasingly recognizing their value. In fact, embracing a VDR can give startups a significant edge in today’s competitive landscape.

For young, ambitious companies with big ideas and limited resources, VDRs present a unique opportunity to establish a professional foundation and gain the trust of investors and partners. It’s more than just a document sharing platform, VDRs act as a centralized hub for sensitive information, ensuring its confidentiality and providing auditable trails, which is crucial in establishing credibility with investors. Imagine presenting a detailed business plan or sharing financial statements – all securely stored and accessible with controlled permissions.

Besides that, a VDR empowers startups to move fast. Forget sending documents back and forth via email or cloud storage – VDRs streamline the entire process, allowing for efficient due diligence and negotiation, making vital decisions much faster. It’s almost like having a virtual team dedicated to keeping all information organized, controlled, and accessible. And remember, startups thrive on speed, being able to quickly adapt and respond to changing markets & investor expectations.

Startups are entering a competitive field, so making a good first impression is essential. By using a VDR, they signal their professionalism and seriousness to potential investors. This added layer of professionalism sets them apart from other startups, and provides that extra nudge that can seal the deal. With limited resources and high ambitions, startups need every tool at their disposal to make an impactful impression. That’s where the virtual data room steps in – a powerful and versatile tool that elevates the startup experience to new heights.

Virtual Data Rooms for Startups: Why You Need One ASAP

In the fast-paced world of startups, securing funding is crucial for growth and achievement. A virtual data room (VDR) can be a game-changer for startups looking to streamline their fundraising process and attract investors.

What is a Virtual Data Room?

A virtual data room is a secure online platform where you can store and share sensitive documents with potential investors during the due diligence process. It’s essentially a digital vault for your confidential information, providing a secure and organized environment for fundraising.

What are virtual data rooms used for?

Virtual data rooms are primarily used for:

- Startup funding: Sharing essential documents with potential investors during due diligence.

- Mergers and acquisitions (M&A): Facilitating the exchange of confidential information between merging companies.

- Legal proceedings: Securely storing and sharing legal documents with stakeholders.

How do virtual data rooms work?

VDRs operate on a cloud-based platform, allowing you to access and manage your data from anywhere with an internet connection. They typically offer robust security attributes, such as:

- Encryption: Protecting data during transmission and storage.

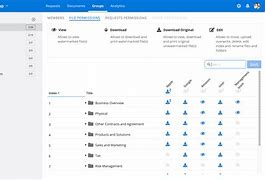

- Access controls: Granting specific permissions to varied users based on their functions.

- Watermarking: determineing users who access specific documents.

- Audit trails: Tracking all activity within the VDR.

The varied types of virtual data rooms available

There are various types of virtual data rooms available, each with its own set of attributes and pricing models. Some common types include:

- General purpose VDRs: Suitable for a wide scope of use cases, including fundraising, M&A, and legal proceedings.

- Industry-specific VDRs: Tailored to meet the specific requirements of certain industries, such as healthcare or finance.

- DIY VDRs: Allow you to create your own virtual data room using existing cloud storage services.

Why Do Startups Need a Virtual Data Room?

Virtual data rooms offer a plethora of benefits for startups seeking funding. Here are some key reasons why you should consider using one:

Streamlining Fundraising:

- Securely store and share documents with potential investors: VDRs allow you to securely share essential documents, such as business plans, financial statements, and legal agreements, with investors.

- Accelerate the due diligence process: Investors can access and review documents quickly, speeding up the due diligence process and moving your fundraising timeline forward.

- boost transparency and trust: A well-organized and secure VDR demonstrates professionalism and transparency, building trust with potential investors.

Managing Due Diligence:

- Securely organize and manage all due diligence documents: VDRs offer a centralized platform to store and organize all documents required for due diligence.

- Control access and permissions for varied stakeholders: You can set specific access levels for varied users, ensuring only authorized individuals can view sensitive information.

- Reduce administrative burden and manual processes: VDRs automate tasks and streamline processes, reducing the administrative burden associated with managing due diligence.

Enhancing Collaboration:

- Facilitate communication and collaboration between team members: VDRs foster communication and collaboration among your team members, enabling them to access and share documents seamlessly.

- Promote transparency and accountability: VDRs promote transparency by providing a clear audit trail of all activity, fostering accountability and trust among stakeholders.

- Create a centralized hub for all crucial documents: VDRs act as a centralized repository for all crucial documents, making it easier to access and manage information.

The benefits of Using a Virtual Data Room for Startup Funding

Beyond the above, VDRs offer numerous benefits that can significantly impact your startup’s fundraising journey:

Faster Funding Rounds:

A virtual data room streamlines the due diligence process, allowing investors to quickly access and review necessary information, which accelerates the overall fundraising process. This can significantly reduce the time it takes to secure funding, allowing you to focus on growing your business.

Enhanced Security:

Virtual data rooms offer robust security attributes like encryption, access controls, and audit trails, ensuring sensitive information is safeguarded. This reassures investors that their confidential data is protected, increasing their confidence in your startup.

Improved Investor Confidence:

A well-organized and secure virtual data room demonstrates professionalism and transparency, building trust with potential investors. Investors are more likely to invest in startups that present themselves as organized and secure, knowing their data is in safe hands.

Reduced Costs:

By automating tasks and streamlining processes, virtual data rooms can significantly reduce administrative costs associated with fundraising. This allows you to allocate more resources to other areas of your business, such as product development or industrying.

Choosing the Right Virtual Data Room for Your Startup

selecting the right virtual data room is crucial for a achievementful fundraising experience. Here are some factors to consider:

- Consider your specific needs:

- What attributes are essential for your fundraising process?

- How many users will need access to the data room?

- What is your budget for the virtual data room solution?

- study and compare varied virtual data room offerrs:

- Read reviews and testimonials from other startups.

- Consider the ease of use, security attributes, and pricing of each offerr.

- Request a demo:

- Get a hands-on experience with the platform and ask querys about its attributes and capabilities.

Implementing a Virtual Data Room for Your Startup

Once you’ve chosen a VDR, it’s essential to implement it effectively. Here’s a step-by-step guide:

1. Organize your documents:

- Gather all pertinent documents, such as financial statements, legal agreements, and business plans.

- Categorize and organize them into logical folders for easy access.

2. Set up user permissions:

- Determine who needs access to the virtual data room and grant them appropriate permissions.

3. Communicate with stakeholders:

- Inform investors and team members about the virtual data room and how to access it.

Conclusion

A virtual data room is an essential tool for any startup looking to secure funding. By streamlining the fundraising process, enhancing security, and improving collaboration, a virtual data room can help startups raise capital faster and more efficiently. Investing in a virtual data room is a wise decision that can offer long-term benefits for your startup.